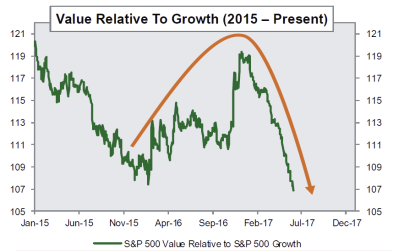

Since the great recession, the equity market has recovered and moved to new highs, fueled by a strong corporate profit cycle. However, during this time period, the marketplace has seen short-term dispersions develop between asset classes. Geopolitical events or concerns regarding the level of future economic growth have surfaced at times and fueled short-term volatility. Early in 2017, these influences led the marketplace to return to favoring companies with greater growth orientation and “safe-haven” asset classes. This trend continued for most of the second quarter. Year-to-date through the end of May, growth indices led value across all market capitalizations by a wide margin – 1200 basis points! A significant feat, as it took a year to generate a similar dispersion early in 2016. Value relative to growth has now returned to prior 20-year trough levels last seen in early 2016 and 2000.

Not surprising, market commentary (similar to early 2016) has resurfaced questioning whether investing in low valuation securities can generate superior long-term performance. We remain as confident as we did in early 2009, mid 2012 and again early 2016 that these worries will subside and better performance will return in the not too distant future.

So, what gives us confidence that the environment will improve for Value? Nearly 100 years of data would support that low valuation investing generates superior long-term performance, however, it’s not uncommon to see below market returns over shorter time periods. History shows nearly every period of underperformance has been followed by strong outperformance.

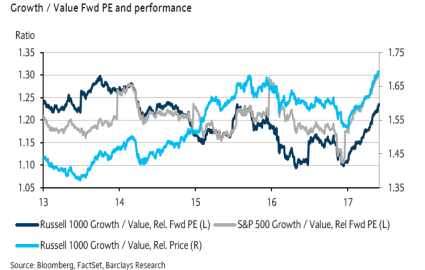

Secondly, current valuation multiples between Growth/Value is approaching the early 2016 highs.

During 2015, Value experienced price-to-earnings multiple contraction detracting from investment returns; that similar magnitude has taken place in the first half of 2017. While Growth has been a significant beneficiary this year from valuation expansion, price-to-earnings multiple expansion has contributed 11%+!

Lastly, the wide dispersion between sector returns that has recently favored Growth versus Value. The Technology sector is a large contributor to growth indices as is Financials and Commodity sectors to Value. Year-to-date, Technology sector returns have been twice the overall market. While Financials and Commodity sectors had a strong performance year in 2015, the sectors have had a slow start to the year, trailing the market by a wide margin through the end of May. We see Financials and Commodity sectors improving during the back half of the year. The Financial sector will continue to benefit from the rise in interest rates, less regulation and an increase in the rate of capital returns to shareholders.

Daniel Lysik, CFA manages two strategies: Deep Value Strategy focuses on out of favor securities at very low valuation levels and deep discounts to their intrinsic value, whose current market price does not reflect the companies normalized earnings for free cash flow power, and Concentrated Deep Value Strategy, which is the most deeply mispriced subset of the Deep Value Strategy and typically provides greater exposure to lower market capitalization holdings. Email us for more information.