Over the past couple of years, we have seen some wide divergences take place within asset classes over shorter time periods. Year-to-date within the equity market would be one such instance. The S&P 500 Index has had a strong start to the year, returning +9% – one would think all equities are participating. However, digging deeper, I see the marketplace breadth has been quite narrow with the top 10 contributors attributing nearly half of the market return and growth-oriented subset significantly outpacing value. Looking at Russell benchmarks, Growth has led Value across all market capitalizations, by a wide margin, 1000-1300bps, year-to-date:

| Russell Top 200 Growth Index +16.62% | Russell Top 200 Value Index +3.24% |

| Russell 1000 Growth Index +15.41% | Russell 1000 Value Index +3.53% |

| Russell 3000 Growth Index +14.89% | Russell 3000 Value Index +3.12% |

| Russell 2000 Growth Index +8.65% | Russell 2000 Value Index -1.46% |

Source: Bloomberg. As of 6/7/17

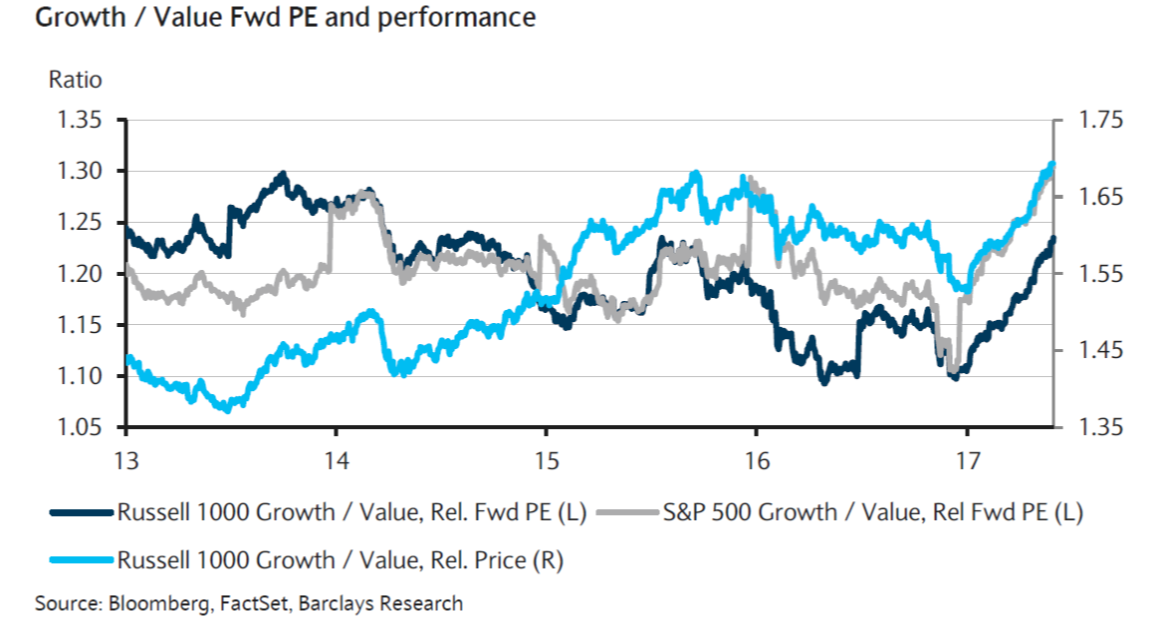

As Barclay’s Research recently highlighted in the chart below, the recent outperformance by Growth versus Value is now approaching the historical extremes last seen in late 2015.

With the recent increase in geopolitical concerns and rising fears of slowing economic growth, it’s understandable that the market would gravitate to companies that continue to deliver growth in excess of the overall market. However, we believe Value oriented industries and companies will continue to do just fine and currently provide long-term investors with a significant investment opportunity.

Daniel Lysik, CFA manages two strategies: Deep Value Strategy focuses on out of favor securities at very low valuation levels and deep discounts to their intrinsic value, whose current market price does not reflect the companies normalized earnings for free cash flow power, and Concentrated Deep Value Strategy, which is the most deeply mispriced subset of the Deep Value Strategy and typically provides greater exposure to lower market capitalization holdings. Email us for more information.