Deep Value Strategy 2Q 2021 Letter

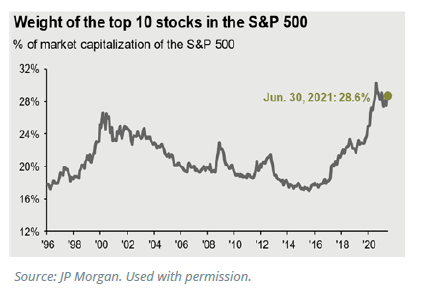

During the ongoing economic recovery of the past year, low valuation securities have done quite well, generating returns well ahead of the overall marketplace. Value’s resurgence was long overdue. Over the past 50 years, Pro-Value cycles have lasted on average in excess of 5 years. During these time-periods, low valuation securities have on average generated cumulative returns more than double the overall market returns. . We were looking for clues that may support a longer duration pro-value cycle. First, there has been a significant amount of narrowing of the marketplace as a smaller number of companies have taken on larger percentage of Index weighting. The S&P 500 hit a 40-year record high level of concentration late last summer. Over the past year, the market has slowly started to broaden out, but the top 10 weighting remains quite elevated at nearly 30%.

Today the combined market cap of the top 35 (previously 30) companies of the S&P 500 Index are nearly equivalent to the combined market capitalization of rest of the index. As we previously highlighted, a closer look at the drivers of concentration within the S&P 500 Index reveals a significant representation of larger market capitalization growth companies. Over the past year, the S&P 1500 Growth Index top 10 weighting has increased and now stands at a record level in excess of 46%. We are not entirely surprised, as we highlighted in previous letters, that the growth universe has generated superior historical earnings and free cash flow growth for most time periods since The Great Recession. Longer duration equities have also benefitted from significant valuation expansion as a direct result of record low interest rates. We still see a significant opportunity for the market to broaden out, which should continue to benefit unloved and in some cases under-followed lower valuation securities.

While Covid-19 created a catalyst event that led to the significant bifurcation in the market, the ongoing recovery should continue to support a narrowing of the marketplace. The deep contraction due to Covid-19 created significant pent up demand and the potential for economic growth to be well above historical levels for an extended period. Unlike the period following The Great Recession, we expect the growth recovery to be greater than historical averages and more companies should be able to grow in excess of the overall marketplace. With an accommodative Federal Reserve and significant ongoing fiscal stimulus, there is potential that cyclical earnings growth could lead the market well into 2022 and beyond. We also highlighted last Fall how the S&P 1500 Value indices had 2-3x higher exposure to cyclical sectors that were near 50 year low representation in the S&P 500. Given the ongoing outperformance of some of these sectors, cyclical representation has increased to 3-4x and may continue to provide the opportunity for the marketplace to broaden out further over the coming year.

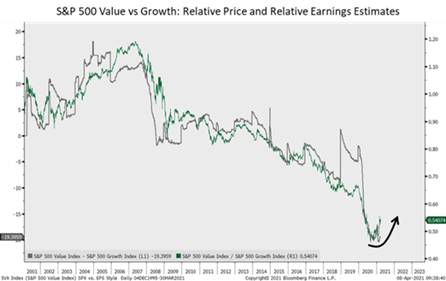

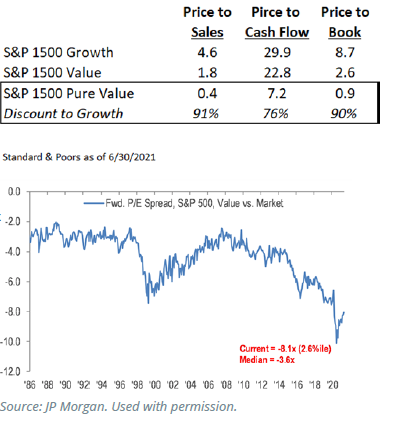

Finally, we revisited the wide valuation spreads that have typically been in place prior to a Pro-Value outperformance cycle. Over the past 9 months, valuation multiples have expanded across all areas of the marketplace. However, low valuation securities remain at very attractive absolute levels and still at a very significant (>75%) discount to longer duration equities.

We find the valuation spread interesting and unwarranted as the corporate debt market is suggesting that there is lower risk to corporate balance sheets versus history. Many cyclical companies are seeing improving operating trends and their business models remain well below normalized earnings and free cash flow. Suggesting that low valuation equities have the ability to continue to outperform the marketplace over the coming year led by accelerating earnings and free cash flow growth and ongoing valuation expansion.

Where could we be wrong with our view? A resurgence of Covid-19 is an ongoing risk as any follow-on outbreak could create headwinds to future demand and increase market concerns regarding a slower recovery. As we have seen for short time periods over the past 9 months, rising uncertainty and volatility tend to lead to lower interest rates and short-term pull back in portions of the marketplace that stand to benefit from an economic recovery. Recently we have seen increasing fear of Covid-19 Delta variant becoming more widespread over coming months. As a result, the market has favored more growth-oriented companies and the 10-year treasury bond yield has retreated towards 1.25%. We believe ongoing stimulus, a healthy consumer and an improving employment environment will continue to be an offset for these market fears. We still see an environment supporting above average economic growth, rising inflation, and, eventually, higher interest rates. All have historically tended to coincide with Value outperformance. After a strong first half of the year, the market may experience some near-term volatility, however we continue to believe a bond market with an 80x multiple poses greater risk of capital loss. While the market will likely continue to debate the duration of the Pro-Value cycle, we see an ongoing environment that suggests that lower valuation securities should do well as the economic recovery continues.