Strategies that invest only in fixed income have struggled to provide in this low-interest rate environment, but the ingrained belief that these are safe and reliable sources of income continues to drive billions of dollars into the asset class. After recently reading an article titled “The Chase for Yield Is On,” I paused for a moment, conjuring up an image of investors chasing the elusive carrot around and around a track.

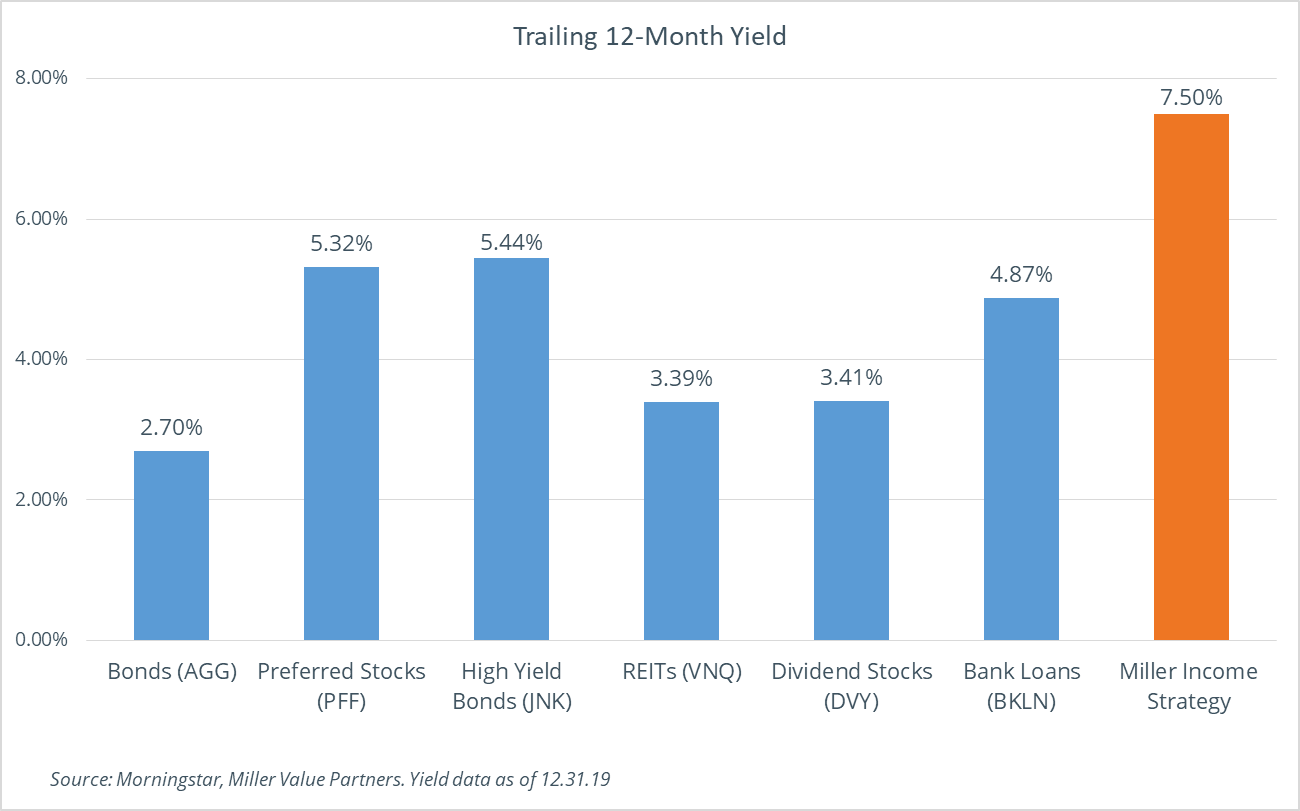

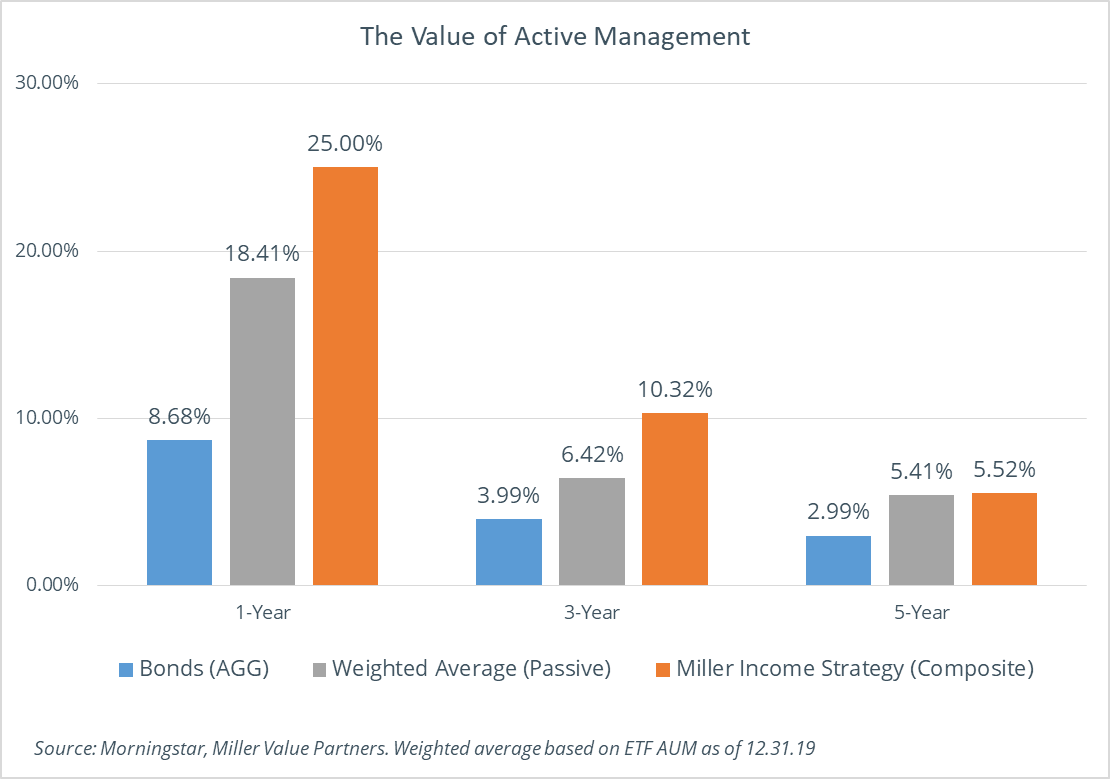

Looking at the areas of the market where investors often seek high yield, passive investing in each provided investors with higher yield and better returns than the iShares Core US Aggregate Bond ETF (AGG) in 2019. But what about the added value of active management? Flexibility, bottom-up portfolio construction, and concentrated positions are hallmarks of our approach that we believe lend to improved long-term returns. It’s less of a “chase” and more of a “plant the seeds for growth” approach, and it provides investors with a portfolio of undervalued companies in areas where we see the best opportunity.

Trailing 12-Month Yield (as of 12.31.19)

Annualized Performance % (as of 12.31.2019)

| 1-Year | 3-Year | 5-Year | |

| Bonds (AGG) | 8.68 | 3.99 | 2.99 |

| Preferred Stocks | 15.62 | 6.05 | 4.79 |

| High Yield Bonds (JNK) | 14.97 | 5.83 | 4.76 |

| REITs (VNQ) | 28.91 | 8.36 | 7.17 |

| Dividend Stocks (DVY) | 22.66 | 9.73 | 9.47 |

| Bank Loans (BKLN) | 8.83 | 3.48 | 3.23 |

| Miller Income Strategy | 25.00 | 10.32 | 5.52 |

Source: Morningstar, Miller Value Partners. Income Strategy composite data is net of fees. For important information, please click here

What if an investor opted to diversify their income portfolio using these passive strategies? We looked at a cap-weighted average performance for the periods and our active income strategy still delivered better returns.

Annualized Performance (as of 12.31.19)

Bill Miller IV, portfolio manager, answered questions on a recent call about the Income Strategy’s performance in 2019, providing further insights into our active management approach to income. Here’s a recap of that discussion:

Q: What drove the Income Strategy’s strong performance last year?

Bill Miller IV: The Strategy was up 25% last year, which is easy to dismiss, given that a passive equity index was up more than that. What’s not so obvious is that when you break down the portfolio’s performance into high-yielding equity holdings and debt holdings, both asset classes did really well versus similar asset types. Our equity holdings, in aggregate, narrowly outperformed the Russell 3000 on gross return, doing over 31%, which is compelling because we are picking from, and actively managing, an extremely constrained subset of the market – one with a high level of yield that’s generally cheap for a reason. If you take a look at the Russell 3000 and examine the performance of all names that ended last year yielding north of 5%, their average total return in 2019 was 11%, which we nearly tripled. If you only look at equities yielding 7% or more, which is the current yield of the Strategy, the average total return drops to 6.5%, which we nearly quintupled in the equities we owned. We also own bonds, which did really well as a group too, generating a nearly 17.5% gross return, or over 300 basis points better than the high-yield index. So our security selection and active position sizing within both bonds and equities drove a really good 2019.

Q: With a flexible mandate, Income Strategy’s equity-to-fixed income breakdown is now roughly 60/40. Why increase fixed income given your optimistic outlook?

Miller IV: At the end of the day, it comes down to a calculated bet that we will be able to generate better risk-adjusted returns at the portfolio level, but there are actually two main reasons why we think this is the case: 1) Reduced perceived and real risk in certain individual bonds versus equities, and 2) Attention management and its implications for portfolio construction.

Perceived, and arguably real, risk is so much lower in individual bonds than in individual equities. When you compare the volatility, which is a good proxy for “perceived risk,” of an individual bond to that of an individual equity, even a risky bond’s volatility is going to be a fraction of the volatility in most of the equities we own. The practical implication for us is that when we find individual bonds whose forward return profile is fundamentally compelling, we need to make them much bigger positions than we have in the past. One of our biggest mistakes over the past few years has been in not making individual bonds we liked even bigger. For instance – we started buying our CenturyLink (CTL) bonds in the 80s with the belief that over a multi-year time period they were going to 120. Now they’re 105, and the market is telling us that we are probably right, and they should have been bigger and maybe still should be even though they’re 105. Who doesn’t want a 7% current yield with 15% upside in a bond with minimal volatility? In addition to lower downside volatility than equities, the benefit of having more bonds in the portfolio is that it allows us to focus more heavily on our more volatile equity positions, and to be more opportunistic in adjusting weights of those positions.

Q: We’ve discussed the alternative asset managers quite a bit. After having an extremely strong quarter, with Carlyle Group (CG) and Apollo Global Management (APO) returning almost 30%, how much more upside potential is there?

Miller IV: There is still substantial upside potential in both those names, we think, which is why they remain among the Strategy’s largest positions. We have long thought that their structure as publicly traded partnerships was likely preventing the market from fully appreciating their value, and both Apollo and Carlyle recently completed their conversions to corporations. With more eyes on these stocks, we think the next few earnings reports will help them realize that potential. Blackstone (BX) was a large position for a while, and we sold out of that one too early, as it has continued to move higher after we sold it. We still think APO and CG are fundamentally undervalued while BX is pricier.

Q: Can you walk us through a recent eliminated position?

Miller IV: One of the challenges with owning secular decliners is that they require a more active approach than does a secular grower, mainly because declining fundamentals mean the intrinsic value declines over time, which is not the case for secular growers with a moat, whose intrinsic values tend to grow over time. National Cinemedia (NCMI), which we reduced significantly in the fourth quarter, is one such example. I highlight this one because I think it is a successful case study of our ability to own a secular decliner and trade it really well based upon our assessment of intrinsic value. This stock is the largest on-screen movie advertising network in the US, and our average cost on it begins with the number 5, while our average sale price is much closer to 8 than 5, with a nice yield clipped along the way. When we paid $5-6 for our position, we thought it was worth significantly more; however, ongoing declines in the business caused management to consistently “miss” what they had deemed extremely conservative guidance, causing us to revamp our assessment of intrinsic value and establish a firm sell discipline and get out at the right time. I think that dividend is at risk; if they cut it and the share price overreacts, we’ll be ready to take another look.

Q: Finally, where are you finding opportunities right now?

Miller IV: I discuss the summary thinking on three of our newer bond positions including Bed Bath & Beyond/Alliance Resource Partners/GameStop in my 4Q Letter, so I’ll flag a few equities that we like.

First, I want to give some background on what we look for — securities with yield that have an asymmetric forward return profile, that is to say they have more upward skew probability than downward skew probability. This first idea falls into the “good business temporarily at a discount due to a surmountable challenge” bucket. Danske Bank (DANSKE DC) is a $14B market cap company and the largest bank in Denmark trades with a dividend yield over 7% and 9.8x this year’s earnings and this is a trough earnings year. It operates in 13 countries but is most prevalent in the Nordic region, and it got into some hot water after an Estonian subsidiary they bought supposedly laundered money for clients in Eastern Europe. Because of this, compliance costs have skyrocketed temporarily, but the bank expects to double its returns on equity over the next three years, which should lead to meaningful multiple expansion. Even at its current earnings level, we think it’s worth more than where it trades, and If management falls a little short of its goal, we don’t think there’s much downside given that the company trades at just 60% of book value, which is its lowest level ever.

There are also a few overleveraged secular decliners whose sell-offs have made them really interesting values, we think. QUAD Graphics (QUAD) is a name that was apparently too big when we owned it around $10/share, as it now trades around $5 after slashing the dividend and lowering guidance in what looks to be the worst year in the company’s 47-year history, during which it attempted to buy LSC Communications and got blocked by the Department of Justice. We realize printing is not a secular growth business, but we think that a combination of debt pay-down and better execution could help shares move higher. Also, we ran a quantitative analysis of every stock that cut its dividend over the past 15 years, and a variety of aspects of this dividend cut appear to bode well for future relative performance, purely from a quantitative perspective.