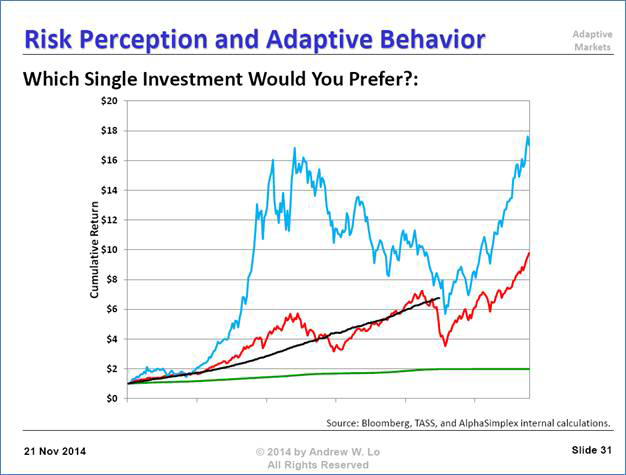

Members of our team recently attended the Harvard Behavioral Finance Conference. Professors and practitioners from varying institutions spoke about the bounds of human rationality and how they affect financial decision-making and asset prices. One of the most fascinating presentations came from MIT’s Andrew Lo, who talked about the evolutionary basis for many irrational human behaviors. At one point in his presentation, he displayed the following slide and asked the group which asset they would choose for the bulk of their savings:

Roughly half of the room chose either the black or red line, while most of the other half chose the blue line. The blue line is the most volatile asset, yet despite the volatility, the cumulative total return since inception almost never falls below that of the red or black lines. In other words, people are willing to trade volatility for lower returns even when the cumulative total return of the more volatile asset is never less than the cumulative total return of the less volatile asset. There is clearly value in predictability of a nest egg, but prioritizing predictability over the value itself does not make much sense, unless those who prefer the red and black lines are protecting themselves from their own irrationality (they know they’d buy at the highs and sell at the lows). One interesting note — the black line stops before the end of the chart because it’s the reported returns for Bernie Madoff’s fund.

The obvious implication for investors is that volatile assets may be a fertile ground for investment ideas. That is indeed one of the places we look for opportunities – controversial names that tend to be more volatile. We believe that looking beyond near-term volatility and practicing “time arbitrage” may allow us to earn a higher rate of return than we would if we viewed assets through the increasingly short horizon the market seems to use.