Active Investing has recently gone through a tough stretch, with less than 30% of active investment managers outperforming the market over the past two years. While it’s only been two years, in many ways its felt like an eternity! Passive investing’s recent success has been well documented in the popular press and further reinforced by a marketplace that is eager and willing to create new products to capture the current consensus trend (not surprising, I think we’ve seen this movie before)!

Twenty years ago, I can still hear the constant trumping of a Senior Portfolio Manager as a subset of the marketplace climbed to extreme valuation levels. “It’ll continue to work because IT’S WORKING”…Hmm, did I miss that chapter in Graham & Dodd’s Security Analysis? Maybe it was before the one on Intrinsic Value or was it after the chapter on Margin of Safety? Sure enough as equity valuations multiples peaked, the market euphoria exhausted itself, and we quickly found “it” stopped working. More importantly, the bifurcation of the market of the late 1990’s gave way to the beginnings of a long outperformance cycle of Active and Value Investing.

Some of the greatest historical investment opportunities have been at the intersection of significant marketplace dislocation, misperception of volatility with risk and, most importantly, where Mr. Market was so convinced the current environment would continue that it provides significant value for an investor willing to take a long-term, contrarian view.

During the great recession of 2008-09, as GDP contracted by over 5%, most companies experienced significant revenue pressure leading to margin compression and cash flow and earnings to fall well below normalized levels. Not surprising, as the market feared the continuation of these trends, equity valuation multiples (e.g., P/E, P/B, P/CF, P/S) compressed to near all-time lows. During this time, there were tremendous opportunities in most equity asset classes as growth companies saw valuation multiples compress to levels that discounted significantly lower future growth, in the most extreme cases no growth. Cyclical companies saw profitability fall through historical troughs, and valuation multiples compressed to 30-year lows. A longer-term investor had the perfect scenario to generate above average returns benefiting from cash flow/earnings returning to normalized levels and valuations expanding to reflect the expectations of ongoing profit improvement. From the market lows, S&P 500 Index returns are closing in on being up 200%, with half of the returns from profit growth and the other half from expanding valuation multiples. Passive investors over the past seven years have had the unique opportunity to get paid twice! However, with S&P 500 earnings near all-time highs and valuation multiples near 20-year averages, the current environment appears to be getting more challenged for passive investors.

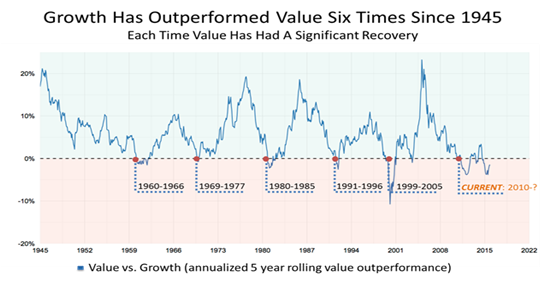

So where today are some of the greatest dislocations that have the potential to create above average returns over the coming years? Similar to late 1999 and early 2009, we believe value investing looks very attractive. As you can see from the chart below, looking at rolling 5 year time periods since 1945, Growth has outperformed Value only six times!

Following each of these time periods, Value has outperformed Growth investing by 50%+ and more importantly Value has outperformed the overall market!

The environment over the past year, has led the marketplace to become very fearful again of a global recession creating another flight to safety. Significant capital has poured into bonds and bond-like surrogates, pushing these perceived “safety/stability” subsets of the marketplace to historically high valuation levels. Growth investing has also done well over this time period as investors have favored investments in companies that it believes will continue to grow at above market rates. Meanwhile the growing recent fears of a recession and prolonged lower interest rate environment have weighed on valuation multiples for some cyclical industries, discounting the potential for lower earnings and cash flow generation over the coming 12-18 months. The bifurcation that has been created between these subsets of the marketplace has now reached historical wide extremes. Investor fears over the past year have created significant volatility, leading to great long-term opportunities for a long-term patient investor. We believe that as global economic fears subside, the marketplace will begin to recognize these incredible equity market dislocations, and Value and Active Investing will once again embark on another long outperformance cycle.