A Checklist for Evaluating Active Management

A friend who manages investments for a state pension fund recently told me that every time the team discusses a new position in an actively managed fund, at least one colleague asks, “Why should we put any money into active management again?” The question is a fair one, as actively managed funds in the aggregate have failed to outperform passive strategies after deducting expenses. And so, money continues to pour out of actively managed funds and into low-cost, passively managed exchange-traded funds (“ETFs”). While the shift is economically rational, liability reduction and self-preservation seem to prevent asset allocators from thinking critically about the logic behind their actions, as well as how they might maximize the probability of outperformance for active managers they retain.

The overwhelming assumption behind the shift to passive strategies is that past is likely to be prologue, and therefore, active managers are likely to continue to underperform their benchmarks. This is true in the aggregate. However, if the premise is that past is likely to be prologue, then why not shift those funds to managers who have outperformed their benchmarks consistently and by significant margins over very long periods of time?

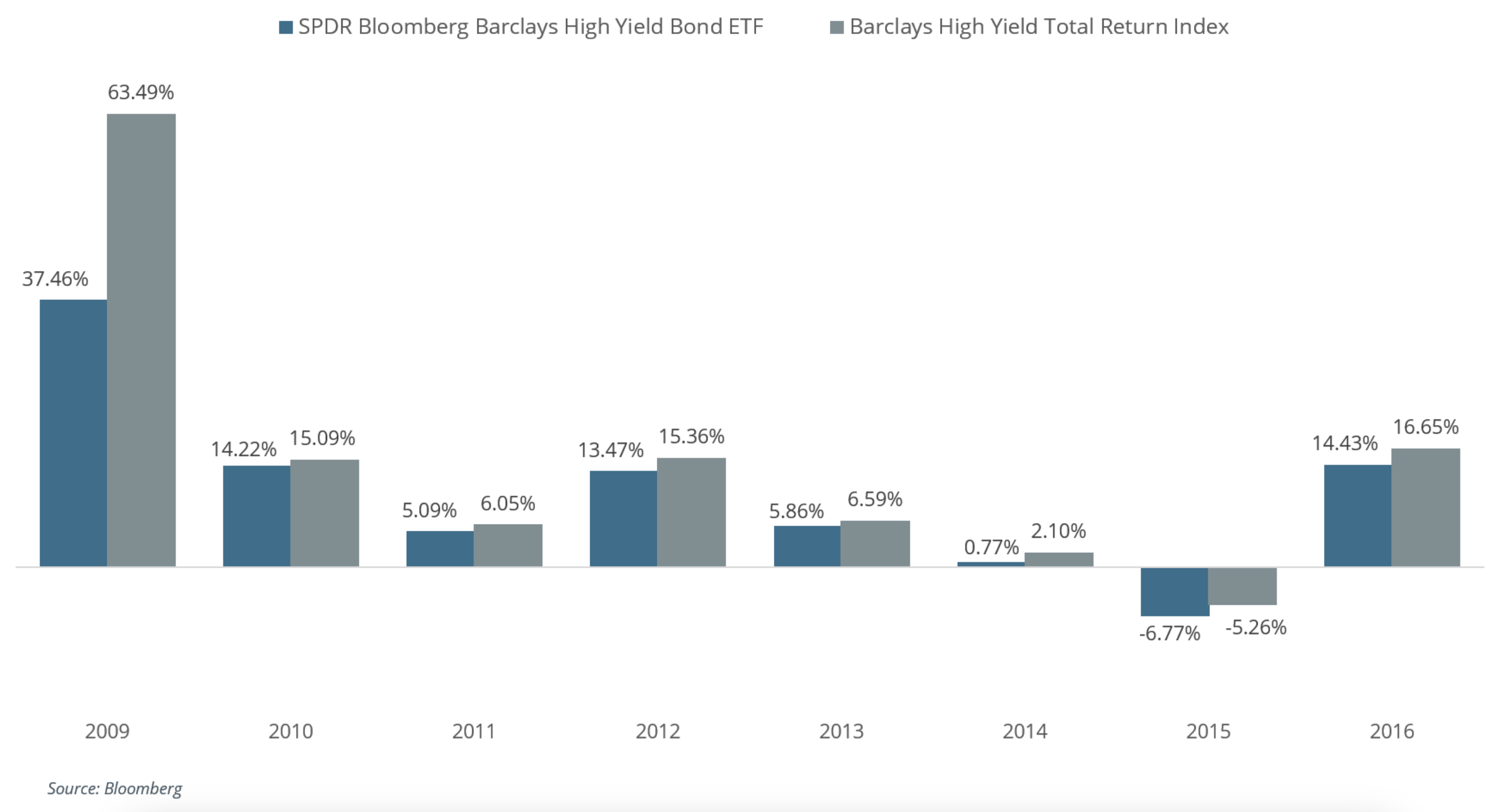

Also, passive investing does not provide the benchmark’s return. It typically provides guaranteed underperformance by an amount equal to the ETF’s fees as well as any liquidity premium afforded by the ETF. The “liquidity premium” means reduced future returns in exchange for higher liquidity than the underlying assets of an index or ETF. Uninvestable indices often serve as the benchmark for high-yield strategies. Access to these strategies means buying passive ETFs with intraday liquidity, which is likely to mean lower returns than the stated, less-liquid benchmark. For instance, one of the largest high-yield ETFs is the JNK, which has failed to outperform its stated index in all eight of the last eight calendar years, with the average annual underperformance being 4.44%. Even excluding 2009, which was a uniquely volatile time in the market, the average annual underperformance of the ETF has been 1.36%.

So, if passive ETFs aren’t a magic solution to the below-index returns of active managers, what should an investor look for in an active manager? Here is what we suggest as a checklist:

- Compelling Long-Term Record. As everyone knows, “past performance does not guarantee future results.” However, managers who have outperformed their benchmarks by wide margins over very long periods of time are much more likely than managers with bad or mediocre performance to be doing something right. By “long term,” we mean many years, as longer timeframes are more statistically significant.

- Repeatable Competitive Advantage. A good manager should be able to explain their competitive edge and why that edge may enable them to outperform the market in the future.

- High Active Share. “Active share” means the extent to which a portfolio differs from the benchmark. Active portfolios that do not differ significantly from their benchmark are likely to perform similarly to the benchmark but charge higher fees, which is a recipe for underperformance. While high active share increases the likelihood of outperformance, it will come with high performance deviation from the benchmark on both the upside and downside, which investors must be prepared to tolerate.

- Reasonable Fees. Costs are the biggest headwind for performance and the primary reason that active management, in the aggregate, fails to outperform passive benchmarks. Higher-fee strategies, such as hedge funds, are much less likely to provide compelling returns than are similar strategies with lower fees.

- Low Turnover. Turnover is a hidden cost that investors need to consider. Strategies with low turnover and longer timeframes are more likely to outperform high-turnover strategies with similar investment approaches, as higher turnover means higher costs.

- Wide Opportunity Set. Constraints are an impediment to solving problems of optimization, and portfolio management is an optimization problem. The smaller an investable universe, the lower the probability that an asset exists within that universe that will outperform the benchmark.

Indeed, recent research by Martijn Cremers supports the idea that concentrated, differentiated portfolios with reasonable costs and low turnover are more likely than strategies without these characteristics to outperform benchmarks. While liability concerns and fear of underperformance continue to drive much of the shift from active to passive, asset allocators would be well-served by considering the logic behind the trends.