Deep Value Strategy 4Q 2021 Letter

The past year saw many twists and turns. In many ways, 2021 ended up being the opposite of 2020. Last year started with growing optimism about Covid-19 as the vaccine rollouts and fewer COVID-19 infections provided incremental hope to the marketplace. Possibly a return to normalcy! However, as 2021 progressed, a resurgence of infections took place in the latter part of the year, first caused by the Delta variant and later by Omicron. Each incremental wave of Covid-19 brought along incremental market fears that a surge in infections could derail the ongoing economic recovery. As Covid-19 infections peaked and trended lower, the underlying economic recovery returned to center stage and quickly became a tailwind for low valuations and cyclical portions of the marketplace.

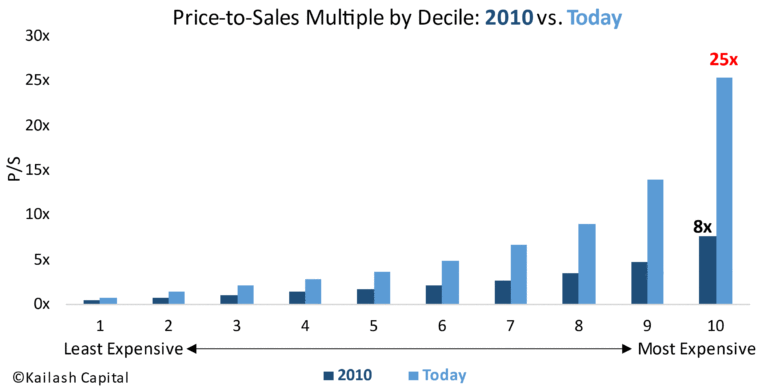

As we highlighted in our Q3 quarterly letter “The Weighing Machine Should Tilt in Value’s Favor”, valuation spreads between the most and least expensive portions of the market ended the year at historically wider levels. We believe low valuation securities, mostly unloved and underfollowed in the marketplace, appear to have more favorable reward/risk opportunities. On the other hand, the most expensive portion of the market continues to see market crowding in companies whose share prices show little appreciation for a price-to-value relationship. Higher valued equities and bonds have been in strong demand by market participants since “The Great Recession” and have become even more popular during the recent Covid-19 infection waves. Longer duration equities (growth and momentum) have had the wind at their backs over the past couple of years – beneficiaries of a slower economic growth environment with minimal inflation and record low interest rates (lower discount rate). The result, highlighted in the chart by Kailash Capital, has led to significant valuation expansion in the longest duration equities. Since 2010, the most expensive decile on a price-to-sales basis has increased from a multiple of 8x to 25x! Wow, quite astonishing! While the highest decile has delivered very strong historical revenue growth, at 25x revenue, market prices appear to be discounting very lofty growth expectations well into the future. In addition, there are a significant portion of companies within this subset that lack profitability and have excessive debt leverage. Historically, these traits have not been a good recipe for a significant “margin of safety”. When the highest quintile has sustained at current valuation levels, future growth failing to meet high expectations or profit improvement failing to materialize has historically preceded sizeable share price weakness and valuation compression.

Source: Kailash Capital, LLC. As of 12/31/21. Large-cap universe divided into deciles by price-to-sales.

On the other end of the chart, the lower deciles are still at attractive valuation levels and a discount to the overall market. Share price weakness in lower valuation subsets may lead to a wide gap between the price and the company’s intrinsic value. This presents an opportunity to find significantly mispriced securities, as a company’s share price may not reflect the underlying business value for numerous reasons (i.e., an out of favor industry experiencing a cyclical trough, companies with business models impacted by cyclical events, secularly challenged companies, and companies going through turnaround/transformation). As Value investors, we believe large price-to-value gaps can present very attractive reward/risk investment opportunities. During periods of share price weakness, the marketplace may overlook that a company owns the assets as well as the business model. Prices of lower valuation securities may not reflect an extensive asset base or a sizable underlying business that has the potential to generate a much larger future cash flow or earnings power.

While Covid-19 has created ongoing waves of infection and market fears, it has also led to an environment with significant liquidity/fiscal stimulus. This historically has led to higher inflation for longer time periods, which suggests that the significant tailwinds that have been in place fueling above-average returns for bonds and longer duration equities could shift to potential ongoing headwinds as interest rates move higher and the economic recovery endures. As we have seen in the past, low valuation equities have done much better in rising interest rate and higher inflation environments. As shorter duration equities, there is less of an impact by a rising discount rate, and cyclical companies have the potential to generate improving earnings and cash flow power in a stronger economic environment.

Where could we be wrong with our view? A return of significant marketplace uncertainty could resurface if COVID-19 infection rates further accelerate or linger longer in time. During these historical periods of rising uncertainty, interest rates have quickly moved lower, and equity market participants have favored defensive and longer-duration equities. However, looking back to prior infection waves, we believe there is a greater likelihood that infections will peak over the coming months versus an ongoing escalation that would impact all of 2022. As the year unfolds, we see the likelihood for a more favorable environment for lower valuation securities and growing headwinds for longer duration equities. Maybe 2022 will be the year where the marketplace has greater scrutiny on price versus value!

Strategy Highlights:

After a strong start to the year, the Deep Value Strategy had a more challenging back half of the year. For the fourth quarter, the Deep Value Strategy was down 8.3%, significantly more than the overall market1 and the S&P 1500 Value Index. As we have previously highlighted, we are focused on generating long-term returns and the Strategy is susceptible to quarterly fluctuations. Historically, negative short-term performance has been accompanied by valuation compression which can lead to strong long-term investment returns for the Strategy. For the year, the Deep Value Strategy was up 57.8%, well ahead of the Value Index and the overall market. 2021 marks the 3rd year in a row that the Strategy has generated investment returns greater than 50%.

During the quarter, we had two main positive contributors, Chico’s FAS, Inc. (CHS) and Endo International (ENDP), where both holdings were up more than 10%. Chico’s FAS, Inc is a turnaround retail investment that operates three main banners (Chicos, White House Black Market, and Soma). New CEO, Molly Langenstein, has done a wonderful job repositioning the banners and dramatically enhancing each brand’s merchandise, which has been well received in the marketplace. The company has also rolled out new digital tools that are expanding its customer base and driving greater efficiencies in the business. We see significant growth over the coming years as Chicos returns to historical revenue and margins levels, and Soma executes on their growth plans to achieve $1B in revenue. In our opinion, Chico’s share price remains mispriced and has long-term upside potential more than 3x the current price.

Endo International continues to execute well on its transformation plan to become a leading specialty pharma company. We believe the company’s branded/sterile injectable portfolio will drive future revenue growth and margin expansion over the next couple of years, and management will continue to successfully optimize the company’s cost structure. While ongoing challenges remain, we believe the risks of opioid litigation and the likely upcoming generic launches against their Vasotec product, are well known and appear to be significantly over-discounted in the company’s current share price.

During the quarter our two largest detractors were Nabors Industries (NBR) and Gannett (GCI), both down more than 20%. Nabors Industries’ share price was negatively impacted by the short-term pullback in energy prices. Late in the quarter, Nabors management held their first analyst meeting in over 5 years. We believe Nabors is well-positioned to benefit from higher energy prices and greater demand in their global high spec rig fleet. In addition, the company’s Nabors Drilling Solutions (NDS) segment is a significant hidden technology service asset that we highlighted in previous letters. We believe Nabors shares remain very attractive. The last time oil prices were at current levels Nabors generated EBITDA greater than $800M, much higher than the company’s market capitalization at year-end!

Gannett’s transformation plan to transition from an analog to digital media company continues to move forward at an accelerated pace. The company is scaling a Business-to-Business digital marketing services (DMS) platform and Business-to-Consumer platform that should generate attractive reoccurring subscription revenues over the coming years. Success on new growth initiatives could generate more than $2B in revenue at higher-than-average company margins. We believe Gannett’s current share price reflects limited success from the transformation plan, as the company has one of the lowest price-to-sales multiples in the marketplace (currently less than .25x). We see significant long-term upside potential in Gannett’s share price, multiples of the current price level.

During the quarter, company announcements and market transactions further highlight the significant value embedded in one of our current holdings. Conduent (CNDT) recently announced their first non-core asset sale at $340M in cash. What is significant about this transaction is the asset sale was at an Enterprise Value-to-Revenue of more than 4x – a significant premium to Conduent’s overall enterprise value. The company monetized less than 3% of company revenue and generated cash equivalent to nearly 30% of its market capitalization, creating significant long-term accretion to the underlying equity value. Recently, The New York Times announced the acquisition of Athletic for $550M. Athletic has 200 sports journalists and generates annual revenue of approximately $65M (acquisition price greater than 8x revenue!). Gannett’s Sports medium has 500 journalists and generates $90M in revenue. The New York Times acquisition price suggests that Gannett’s sports business (approx. 3% of company revenue) is worth close to the company’s current market capitalization! In addition, Gannett DMS’s segment (approximately 15% of total company revenue) has public peers currently valued at 4-8x revenue that aren’t profitable, implying an embedded value for DMS that is multiples of Gannett’s current equity market capitalization. These are just two examples of the opportunities represented in the portfolio. With the Deep Value Strategy’s price-to-sales at .25x, we believe there is significant embedded asset value in our holdings that is being overlooked by the marketplace.

As we highlighted earlier, the Deep Value Strategy has generated strong investment performance over the past couple of years. More than half of the cumulative performance over the past 3 years has come from successful investments that are no longer in the portfolio. Our process focuses on identifying deeply mispriced securities where the market misunderstands the current narrative and fundamental value of the company. We have a deep understanding of the company’s assets and business model. This enables us to be long-term oriented and patient while the market narrows the significant price-to-value gap over time. The ongoing market volatility conditions continue to create attractive investment opportunities, which enables us to refresh the portfolio. At year-end, approximately 50% of the Deep Value Strategy is in new holdings over the past 15 months. We do aim to invest in companies for the long-term – nearly 40% of the holdings have been in the portfolio for more than three years. We believe these long-standing holdings still have significant long-term upside potential that are multiples of their current share price. We remain patient with these investments waiting for the marketplace to close the price to value gap over time. With the recent new additions and long-standing holdings, we are very excited about future return potential. We believe the embedded return potential is near historical highs for the Strategy and the overall portfolio valuation ended 2021 near historical lows. The Deep Value Strategy normalized earnings and free cash flow yield are greater than 30%, and we believe the strategy is at a 60-90% valuation discount to the market and Value Indexes!

We are hopeful that the market participants will recognize the significant price-to-value gap in low valuation securities over the coming years. We believe our Deep Value Strategy provides a distinct investment opportunity highly differentiated from the overall index. We focus intensely on identifying why the market has significantly mispriced a company, what factors facilitate a return to normalized value, and how the company will get there. We are able to develop high conviction on a concentrated portfolio of names, with the top 5 names representing >60% of the total portfolio weight. The portfolio’s high active share provides the potential to be additive to a client’s overall asset allocation. We thank our clients for their trust and will continue to work hard to generate attractive investment returns over the long term.

1As represented by the S&P 500 Index