Deep Value Strategy 2Q 2020 Letter

After registering the quickest ever 30% correction, the market bounced back rather sharply and posted a strong double-digit return over the past three months.The Federal Reserve’s swift actions in providing significant liquidity brought stability to the economic slowdown and reduced stress on portions of the credit market. Some of the hardest hit areas within the equity market (cyclicals and small-cap companies) initially lead the market recovery off its lows in March and continue to show significant signs of improvement. As more states reopened during the month of June, a pick-up of new COVID-19 infections began to occur. Marketplace fears on the pandemic returned, and there was renewed interest in “perceived safety” and longer-duration (growth/momentum) equities. While some market participants expect the rise in new infections will lead to a significant increase in future death rates, the new infections so far have been in a much healthier and lower age cohort.

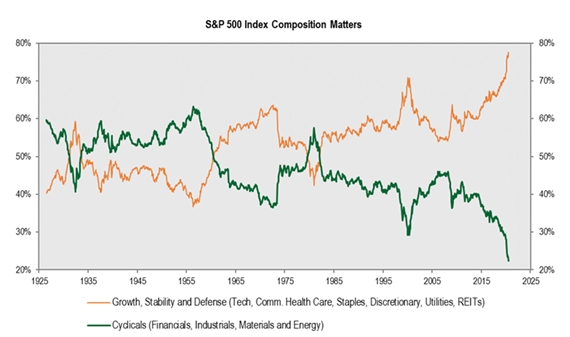

With uncertainty regarding the future impact of COVID-19, the extreme dispersion that became apparent in the first quarter continues to exist in the marketplace today. “Growth, Stability and Defense” sectors continue to see valuation expansion supported by lower interest rates, perceived earnings stability and the belief that future earnings growth will remain stable or at rates greater than the overall market. When uncertainty increases we have seen market participants historically extrapolate current trends well into the future. The chart also highlights that a good portion of cyclical sectors remain out of favor, with most participants’ market prices well below their highs. While these areas of the marketplace have been some of the most impacted by the recent economic slowdown, we also see them as being some of the biggest beneficiaries from an upcoming recovery, thereby having very attractive long-term return potential.

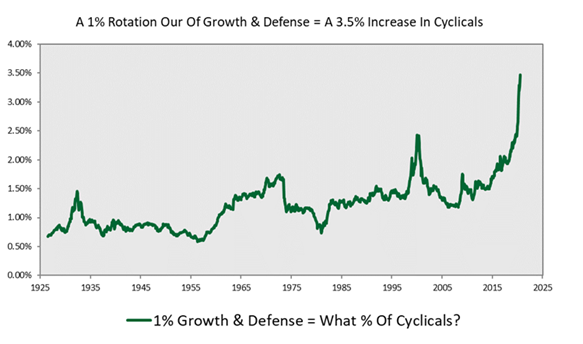

In our last quarterly letter, we highlighted a piece from Empirical Research Partners that focused on the extreme dispersion of current valuation spreads versus history. Valuation spreads have only been this wide on two other time periods in the past 70 years: 1973-74 and 1999-2000. A closer look also shows that the historical time periods of wide valuation spreads coincides with prior troughs for cyclical sector representation in the S&P 500. This is not surprising, as the market fears on cyclical portions of the market are very high at the beginning of a recession. However, history has shown that the eventual reallocation from Growth & Defense areas of the marketplace can be significant near its extremes. As the chart below highlights, a 1% rotation today equals a 3.5% increase in Cyclicals, nearly 50% higher than 2000 and twice 1974 levels.

At the extremes, it’s always difficult to know what could be the catalyst to change market perceptions. History would suggest there are numerous ways for the current extreme valuation spreads to narrow over time. If the economic growth slowdown persists, it may potentially dampen growth for all market participants, which could cause a potential rerating of higher valuation and low volatility equities that are discounting levels of earnings stability and higher future growth. However, the record stimulus that is currently helping to stabilize global economies could also lead to an even greater recovery in economic growth over the coming 12 to 18 months as COVID-19 fears subside. As the marketplace is forward looking, it may begin to narrow the significant price-to-value divergence in lower valuation companies (cyclicals) with attractive long-term business value supported by higher future normalized earnings and free cash flow. We would also highlight the significant amount of liquidity that has been building up on corporate balance sheets and within private equity. As the economy continues to improve, these market participants may begin to also recognize the significant value in lower valuation securities.

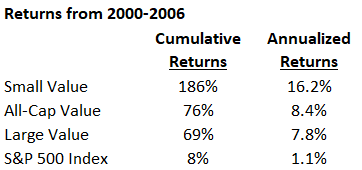

History has shown, these time periods with wide valuation spreads are usually followed by very attractive long-term returns for Value. Post the 2000 peak, Value generated very attractive absolute returns that significantly outperformed the overall market. Today, low valuation securities are at similar absolute levels to 2000 and even wider valuation spreads to the more expensive portion of the market. It makes one wonder when perceptions change if the embedded return potential could be even greater over the next couple of years.

During the second quarter, our Deep Value Strategy led the overall marketplace and S&P 1500 Value index, generating returns in excess of 50%. For the first half of the year, the Deep Value Strategy is still behind the overall market and in line with the S&P 1500 Value index. Historically speaking, the Strategy tends to generate some of its strongest investment returns following a period of significant underperformance and valuation contraction. As cyclicals and some smaller cap companies began to recover from the market lows, we were beneficiaries, as nearly half of our holdings generated returns in excess of 60%. In terms of the largest detractors during the quarter, we had two holdings that were down, Unisys (UIS) and Endo Pharmaceutical (ENDP).

Bed Bath & Beyond (BBBY), one of our largest detractors in the first quarter ended up being our largest contributor during the second quarter, as the share price was up in excess of 100%. While the company has had its challenges over the past couple of years, we disagree with the consensus view that these challenges will continue into the future. We expect that as new initiatives roll out over the coming quarters as the turnaround continues, we will see significant improvement in future operating trends. We like the new CEO’s recent additions to his management team; these are strong executives with significant transformation experience. Bed Bath continues to have a very strong balance sheet (greater than $10/share in cash), has additional non-core assets that will likely be monetized, and is making significant progress in enhancing their store operations. We believe management’s new Omni-channel offerings, significant cost reductions, and new private label offerings should stabilize operations and lead the company to significantly higher normalized earnings and free cash flow over the coming years.

In late March to mid-April we increased position sizes in a couple of our largest underperformers during the first quarter. We were fortunate in our timing as Nabors Industries (NBR) and Taylor Morrison Home (TMHC) quickly reversed course and became two of our largest positive contributors in the second quarter. Nabors Industries (NBR) had been under considerable pressure as the recent economic weakness caused a collapse in oil prices, leading to significant pullback in drilling activity. Nabors management who has successfully managed through prior industry downturns didn’t wait and took aggressive actions to right size their cost structure. The company has a strong global asset base and a significant JV with Saudi Aramco, which provides a considerable margin of safety. Over the past 6 years, Nabors has become the leader in the Supermajors market, gaining 12% of market share from the 2014 market peak. In prior industry downturns, Supermajors have historically benefitted from their size and scale and pulled back less on capital expenditures versus smaller operators. While we recognize that it may take a couple of quarters for the industry to work through the cyclical downturn and see an improvement in new customer demand, we believe Nabors has a strong customer base and the ongoing cost reductions should allow the company to generate strong cash flow. During the upcoming recovery, we believe Nabors should be well positioned to deliver significantly higher normalized free cash flow supporting an intrinsic value that is multiples higher than the current share price.

Late in 2019, Taylor Morrison announced plans to purchase our holding William Lyon Homes at an attractive price of one times book value. We maintained our investment in the combined entity, given our belief that Taylor Morrison has a strong management team and will have a strong presence in the faster growing southeastern and southwestern parts of the United States. The combination also has nearly 80% of their portfolio in Entry Level and 1st Move-up homes, which should be a beneficiary of lower interest rates and strong supply/demand trends. Becoming a top 5 national builder, Taylor Morrison should also benefit from significant scale, synergy savings and growing free cash flow generation. Shortly after the William Lyons deal closed, the company stock price came under significant pressure, along with other homebuilders, on market fears of a housing downturn. The homebuilding underlying industry fundamentals remain strong, and historically, the industry has been one of the first to recover from a downturn. Taylor Morrison’s share price fell below $10/share, a very attractive valuation at 60% discount to tangible book value. We significantly increased our holdings during this time period. Over the next couple of years, Taylor Morrison should see strong margin expansion, return on equity improving towards 15%+, supporting a normalized EPS greater than $4/share. We believe the investment is a very attractive reward/risk opportunity with the potential for the share price to still double from current levels.

Finally, I’d like to highlight a holding that we’ve been recently scaling higher, DXC Technology (DXC), a combination of CSC and the Enterprise Service business of Hewlett Packard Enterprise. We are very familiar with the business, having owned both companies at different points in time over the past 15 years. DXC Technology is a Global IT services company that is focused on helping clients with their mission-critical system and leading digital transformation. While the Technology sector has been a market favorite over the past couple of years, DXC has been far from that. The stock price has been under significant pressure, down more than 80% from its post-merger highs as the company ran into integration challenges. DXC’s new CEO, Mike Salvino, has a strong track record in the industry, previously a very successful senior executive at Accenture. His plan for the company has a lot of similarities to successful action steps taken by Maxar Technologies’ (MAXR) new CEO early in their turnaround: focusing on improving key customer relationships and employee morale, selling non-core assets, significantly reducing cost structure, and looking to reduce capital intensity of the business overtime. DXC’s new CEO is also rolling out new cross-selling initiatives, and his significant multi-year cost reduction program will begin in the back half of this year. Upon completion, it has the potential for more than $700M in savings or greater than $2/EPS. Success in implementing the enhancements should allow the company to return to double-digit EBIT margins and mid-high teens ROE supporting normalized EPS greater than $7/share. It’s worth mentioning that DXC peers, Accenture (ACN) and Cognizant Technology Solutions (CTSH), have low to mid-teens EBIT margins and are currently being valued at price–to-sales of 2 to 3 times, while DXC’s market price is currently at a 70% discount to sales! As the turnaround plan improves operating results and returns the company to growth, we believe the valuation discount will begin to narrow between DXC and their peers. The upside potential for DXC is significant and could be multiples of their current share price over the next couple of years.

We are very excited about the significant embedded return potential in the Deep Value Strategy holdings today. The portfolio valuation which has historically been the best predictor for future return potential and current levels remain near historical trough levels. The strategy ended the quarter with its collective holdings 46% below their 52-week highs versus a market that is near record concentration levels and is not far from its highs. The Deep Value Strategy has a normalized earnings yield greater 25% and greater than 40% normalized free cash flow yield which are multiples of the overall market today. We believe clients are getting an opportunity to participate in very attractive future returns over the coming years. If we see any narrowing of valuation spreads and further improvement in low valuation (cyclical) securities, history has shown that the Deep Value Strategy will be a likely a significant beneficiary. Now appears to be a great time to revisit asset allocation and history would suggest it’s a great time to consider Value!