Deep Value Strategy 4Q 2020 Letter

The past year was a bit of a roller coaster! The COVID-19 outbreak caused significant equity market volatility, 28 days during the year of +/-3%, more than the previous 9 years combined and the most since 2008 (42 days). While some market participants may not enjoy greater volatility, as value investors we welcome the “dislocation”. We have found increased volatility tends to lead to the widening of price-value gaps and greater long-term return potential. Looking back over the past 20+ years, some of our best long-term investments started from one of these corrections.

As we highlighted in our Q1 letter, some of the hardest hit areas earlier in the year were cyclicals and smaller-capitalization companies. With uncertainty regarding the future impact of COVID-19, the marketplace aggressively sold off these areas of the market and crowded into “perceived safety” and longer-duration equities. With the lingering effects of COVID-19 persisting throughout the summer and into the Fall, these impacts on the equity market led to record market concentration and valuation dispersion. As we highlighted in our Q3 letter, we noticed similarities in the marketplace similar to historical time periods that suggested that Value could be on the verge of multi-year improvement. While these areas of the marketplace have been some of the most impacted by the COVID-19 economic slowdown, we see them as being some of the biggest future beneficiaries in the ongoing economic recovery.

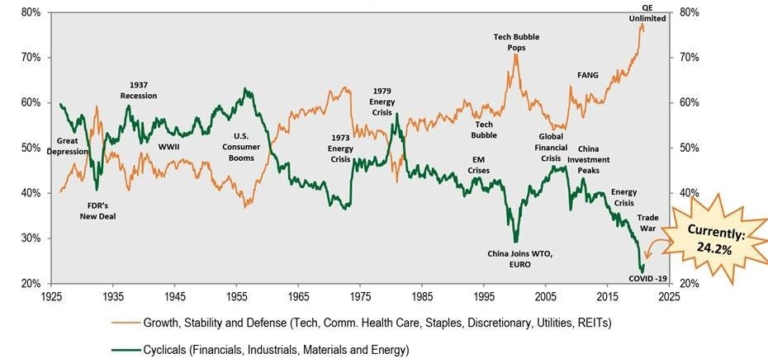

During the fourth quarter, it became apparent that a COVID vaccine would make it to the marketplace by year-end. The market recovery began to broaden out as cyclicals, low valuation and smaller market caps strongly participated and at times lead the overall marketplace. We see the improving environment continuing during the upcoming year. As 2021 progresses, COVID vaccinations should become more widespread and additional economic stimulus should more than offset the impact of higher infections. There is a strong likelihood economic and earnings growth will continue to accelerate, with the cyclical areas likely seeing the greatest benefits. Even with the improvement in cyclical stocks during the fourth quarter, we believe they are significantly under-valued and under-owned. As the chart below highlights, cyclicals (Financials, Industrials, Energy and Materials) representation within the S&P 500, collectively is less than 25% of the index, down from 40% nearly 5 years ago!

These same sectors make up nearly a 60% weighting of the S&P 1500 Pure Value Index, which, along with record valuation dispersions, help further explain some of headwinds that Value has faced over the past couple of years. During 2020, the Energy and Financial sectors ended up being the two largest laggards in the marketplace; the former down in excess of 30%. The Energy sector actually closed the year as the smallest overall sector, as the weighting fell to nearly 2%, even while Energy prices continue on a strong recovery trajectory, quickly approaching early 2020 prices. The commodity price recovery should lead to a significant improvement in revenue and earnings generation for industry participants over the coming year. We believe Energy equities are very attractive as their market prices are still 40%+ lower than early 2020 price levels!

The Financial sector closed near a 10% weighting of the S&P 500, last seen during 2008-09. The underperformance of the bank stocks in 2020 was worse than it was in the Great Financial Crisis! Yet, most Banks have very strong capital levels and loans on their balance sheet, and continue to perform above market and management expectations. These two key conditions were not the case in 2008-09. Similar to the Energy sector, we believe Financials should see a significant improvement in profitability during 2021 as revenue and earnings should benefit from significant lower loan loss provisioning, improving loan growth, strong capital market activity, and a steepening yield curve. Financial security shareholders also stand to benefit from very attractive absolute and relative valuation levels (near historic lows) and a greater return of capital (increased share buybacks and strong dividends).

As we have seen in the recent past, significant marketplace uncertainty could resurface during the year if COVID-19 infection rates further accelerate before vaccinations become more widespread. During these historical time periods of rising uncertainty, we have seen interest rates move lower and the equity market to favor defensive and longer duration equities. However, we would suggest a very accommodative Fed and significant incremental Fiscal stimulus could more than offset these rising concerns and further accelerate economic growth. In fact, we would not be surprised to see incremental signs of rising inflation as the year progresses. The environment is becoming more favorable for cyclicals, lower valuation securities, and smaller cap equities providing investors with significant upside potential over the coming years.

Strategy Highlights

After a challenging start to the year, the Deep Value strategy finished on a high note, building upon the positive inflection in investment performance seen in the third quarter. For the fourth quarter, the Deep Value strategy was up 64.9% (net), significantly ahead of the overall market and more than 2x the S&P 1500 Pure Value Index. For the year, the Deep Value Strategy was up in excess of 70%, well ahead of the Value Indices and the overall market.

During every downturn since 2000, we have tried to learn new things to enhance our investment process. While there are many learnings, we have found our deep knowledge of our holdings’ business models, balance sheets, asset bases and free cash generation capabilities as incredibly important. In addition, companies with strengths in these areas affords the management teams the flexibility to adapt to a rapidly changing environment to maintain the enterprise’s fundamental value and, in some instances, take actions to create even greater long-term equity value. Our in-depth knowledge and relationships with management teams provides us the confidence to take emotion out of investing and make decisions that focus on delivering attractive long-term investment returns with a margin of safety.

The Deep Value strategy tends to favor opportunities where a company is currently operating below a normal run rate of profitability and has the potential for significant future operating improvement to drive the enterprise to higher normalized earnings and free cash flow generation. While the COVID-19 downturn caused near-term operational disruptions to our holdings, we believe the dislocation accelerated the pace of change for many of our companies for the long-term benefit of shareholders. Management teams adjusted plans and were forced to take more accelerated action steps to stabilize and improve the business. We see these actions leading to quicker recovery in revenue and profitability and allow the companies to accelerate the timeline to achieving normalized earnings and free cash flow. In some cases, the management teams were able to take advantage of the dislocation during the year, e.g. accelerating share buybacks or buying back debt at a discount, which should lead to greater long-term free cash flow per share.

As we mentioned after the fourth quarter of 2019, while results may vary over shorter time-periods, the benefits of being patient often leads to strong long-term investment returns for the Strategy. This became visible during the most recent quarter as all holdings generated positive returns and three holdings Nabors Industries (NBR) and Endo Pharmaceutical (ENDP) were up in excess of 80%. We continue to have concentration in these companies as we believe in their ability to continue to drive long-term value.

Over the past couple of months, we increased the weight in the Financial sector. As we highlighted earlier, we believe the recent underperformance by the largest Banks provides a very attractive reward/risk opportunity for long-term investors and should significantly outperform the market over the next couple of years. During the second half of the year, we initiated a position in Wells Fargo (WFC). The company’s share price has been under significant pressure since the 2016 account scandal, leading to senior management resignations, significant incremental expenses, and regulatory oversight. The company has a new CEO, Charlie Scharf, who joined in 2019 from JP Morgan. Charlie has been moving quickly to turnaround the company. He has brought in six new members to the Operating Committee all from outside the company and has recruited numerous successful senior executives from JP Morgan, BNY Mellon, and other leading financial institutions to fill senior roles at the bank. The company is taking a fresh look at each business segment, benchmarking against its peers. The company’s operating efficiency is more than 1700bps out of line with their peer group, providing a $10B cost and efficiency opportunity over the next couple of years. Wells Fargo’s stock price was more than cut in half during 2020; we entered the position at a 40% discount to book value which was near 30 year lows and approaching 2008-09 Financial crisis levels. Over the next couple of years, greater operating efficiencies and loan growth would support a return to 10%+ ROE, normalized EPS of $5/share, and book value likely approaching $50/share. We believe it’s more likely than not Wells Fargo’s share will be a top performer over the next couple of years.

In addition, we have recently increased our position size in Brighthouse Financial (BHF), one of the of the largest annuity and life insurance companies in the U.S. Since separating from MetLife, Brighthouse has built strong sales momentum and has focused on building out a new, less capital intensive business. Brighthouse is targeting nearly $9B in annual annuity sales by the end of 2021 (double 2017 levels) and expanding its life insurance businesses by 10x over the same time period. The company is targeting its capital-intensive business to be 18% by 2025 (half of 2016 levels), which should further enhance future cash flow generation. The company’s capital ratios remain strong and well above regulatory requirements. Management is aggressively returning cash to shareholders, targeting a total of $1.5B in share buybacks by the end of 2021 and retiring nearly 1/3 of their outstanding shares. While the market remains concerned about the impact of lower interest rates and their capital-intensive business, we believe the share price is over discounting these concerns and see the potential impact lessening over the coming years. Brighthouse’s equity appears significantly mispriced, closing the year at a greater than 70% discount to book value and a price-to-earnings multiple of 3 times, a significant discount to its peers and the overall market.

Finally, we would like to highlight a recent addition to the strategy, Gannett (GCI). Gannett has a local-to-national media footprint through the combined entity of New Media Investment Group and Gannett, a merger that took place late in 2019. As a combined force, the company is able to accelerate their transformation, offering significant digital marketing solutions to create an end-to-end suite of digital marketing and production solutions for businesses at any stage. Over the next couple of years, their digital marketing revenues could become a significantly larger portion of the business, more than 40% of the overall revenue. The company also has a significant event business that, while impacted in the near-term by COVID-19, has good growth opportunities by expanding across the combined footprint. There is the potential of $300M of synergies through consolidation of facilities, centralizing operations, expansion of technology systems, and selling non-core assets. We see normalized EBITDA in excess of $700M and annual free cash flow that could approach $500M over the next couple of years, greater than the company market capitalization at year-end. Gannett’s CEO has significant incentive to deliver on long-term merger targets and reduce debt to the benefit of shareholders. The CEO recently received a new contract that will award him 2M shares if the share price is greater than $10 by the end of 2023. We believe a successful transformation of Gannett over the next couple of years is worth in excess of $20/share.

While the Deep Value Strategy had a strong year in 2020, our current holdings valuation levels are still not far from their absolute historical lows. The portfolio today has a normalized earnings yield and free cash flow yield that is greater than 25%, significantly more attractive than the Value indices and the overall market. The Deep Value Strategy holdings are collectively more than 30% below their 52-week high and more than 50% below their 2-year high, while the market is not far from its all-time highs. Returning to normalized profitability and historical average valuation for our holdings over the next couple of years has the potential to generate returns in excess of 200%. We are excited to see an equity market that is transitioning to Value leadership and believe the Deep Value Strategy is well positioned to benefit in 2021.