Deep Value Strategies 2Q 2019 Letter

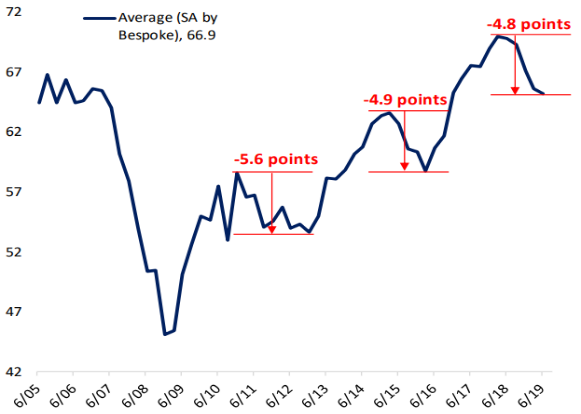

Recently the U.S. economic expansion and equity market recovery surpassed its tenth anniversary. However, the road higher has seen some twists and turns along the way. During the past 10 years, we have seen shorter time periods of temporary rising economic uncertainty leading to growing recession fears. The latest concern has been rising global tariffs and potential impact on global economic growth. During the second quarter, the Economic Policy Uncertainty Index rose to levels last seen during Brexit fears in early 2016. The tariff uncertainty has also started to weigh on U.S. economic optimism which has waned similar to 2016 time period, highlighted below in a recent Duke CFO survey:

Duke CFO Survey, U.S. Economic Optimism

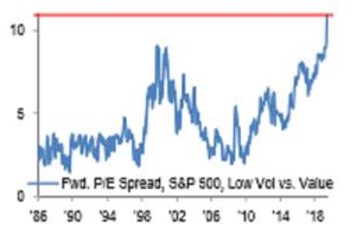

Similar to early 2016, the marketplace has responded to the rise of uncertainty by crowding back into perceived “safe haven” investments. Interest rates also moved lower as risk aversion has increased over the past year. U.S. Treasuries closed the quarter near a whopping 50x multiple! Low volatility equities have also led the market over the past year. With their absolute valuation levels now well ahead of the market, valuation spreads have widened out surpassing 2000 levels! The marketplace appears to be willing to pay any price for “perceived” safety.

Low Volatility/Value:P/E Spread

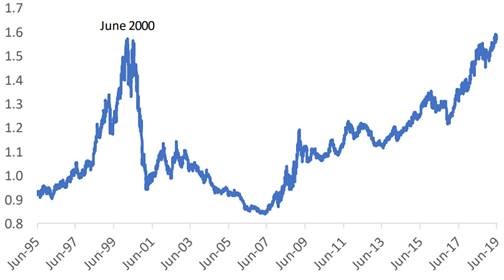

Longer duration equities have also been a beneficiary of the current low-interest-rate environment as Growth has outperformed Value over the past 10+ years – one of the longest cycles on record. Over the past year, momentum equities are also being favored similar to low volatility investments. As Wolfe Research recently highlighted, the momentum part of the equity market has significantly outperformed, as their valuation spreads are now expanded 50% higher than early 2016 levels! While the overcrowding of the market, and

L/S Momentum Basket, P/E Spread

S&P 500 Growth/Value Ratio, 1995-Present

widening valuation spreads makes it more challenging to outperform over shorter time periods, it likely increases the potential to outperform over the long-term. As Benjamin Graham famously highlighted, “In the short run, the market is a voting machine but in the long run it is a weighing machine”. Mr. Market’s ongoing excessive exuberance for “low volatility’ and momentum securities is leaving behind very attractive price-to-value discrepancies for a patient value investor with a long-term time horizon.

After a good start to the year, our Deep Value Strategies lagged the market during the 2nd quarter, falling by 7.7% and 9.1%. For the first half of the year, the Deep Value Strategy is up 6.0% and the Concentrated Strategy is up 9.1% versus the S&P 1500 Value which is up 16.6%.

We had a couple of holdings in both strategies that saw double-digit price increases during the quarter. Avon Products (AVP), Maxar Technologies (MAXR), William Lyons Homes (WLH) and Seaspan Corp (SSW) all were significant positive contributors during the quarter. Avon Products experienced a considerable amount of price pressure last year, first highlighted as a turnaround opportunity in our Q3 2018 letter. While the marketplace remained skeptical of Avon’s new management’s turnaround plan, driving the share price to 80-year lows, we disagreed and increased our position size into price weakness due to a growing discount to the company’s intrinsic value. During the quarter, Brazil’s Natura offered to acquire Avon driving the share price up over 30% and nearly 200% above its lows in 2018. We believe Natura offers the potential to accelerate Avon’s turnaround plan providing higher-margin products and a digital platform to expand on-line sales. We continue to hold Avon as one of our top holdings and await incremental details regarding the combined company potential. William Lyons (outlined in the Q4 2018 letter), along with other homebuilders, benefitted this year from falling mortgage rates and stabilizing-to-improving housing demand. While the stock is up more than 50% so far this year, we continue to hold a sizable position in the company as the valuation remains attractive, a 15% discount to a growing book value. The company is still at a considerable valuation discount to their peers and a discount to their own historical long-term average.

Maxar Technologies became a new investment earlier this year and has recently become one of our top holdings. The company is a global leader of advanced space technology solutions (geospatial data and analytics, satellites, space robotics, space infrastructure, and defense systems) to U.S. and International governments and commercials customers (e.g., Echostar, Uber, Boeing, Lockheed Martin). Maxar suffered a series of setbacks after acquiring Digitalglobe in 2017, causing their stock price to fall over 90% from its highs in 2018. With a new CEO taking the helm earlier this year, we believe the company is aggressively focused on the right initiatives to improve future results. Some key items are right-sizing their satellite manufacturing cost structure which remains at a cyclical order low, enhancing their balance sheet, and reducing the capital intensity of Maxar’s business model. We think the company provides critical products and services to government agencies and commercial clients and has a significant asset base that is being overlooked by the marketplace that is focused on historical challenges. Over the next couple of years, we believe management will be successful in scaling their assets with reoccurring revenue streams which should drive ROIC improvement and significant free cash flow generation. As the company reduces debt by selling non-core assets and future free cash flow, we believe there is a significant opportunity to unlock the equity value and narrow the steep discount to their intrinsic value. During the second quarter, the stock appreciated more than 90% from its recent lows as management accelerated action steps and won incremental long-term contracts. While the turnaround will continue to unfold over the coming year, which could lead to volatility in their operating results, we continue to see their fundamental value significantly higher than the current share price.

Some of our economically sensitive cyclical holdings and smaller market capitalizations, already near all-time low prices/valuation levels, were under considerable price pressure during the quarter, weighing on near-term performance.

Half of the performance weakness came from our Consumer Discretionary companies that are undertaking significant multi-year business transformations. Bed Bath & Beyond (BBBY), Signet Jewelers (SIG) and GameStop (GME) were down over 30% during the quarter. Collectively, these three holdings are at all-time low valuation levels: forward P/E multiples of 3-5x, low single-digit cash flow multiples, free cash flow yields >30% and low single-digit EV/EBITDA multiples. Each company is returning a significant amount of money to shareholders, through either share repurchases, debt reduction or dividend yields well in excess of the overall market. In addition, each company possesses significant non-core assets that can be monetized over time to further accelerate its turnaround and generate incremental cash flow to enhance future shareholder returns. The near-term challenge for all three companies will be to successfully accelerate cost reduction programs and work on incremental ways to stabilize/improve revenue trends. With strong market shares, we see the potential for their substantial asset base to improve profitability over time and generate higher earnings/free cash flow power.

We also saw considerable price weakness from our two generic company holdings Endo Pharmaceutical (ENDP) and Teva Pharmaceutical (TEVA). Over the past couple of years, both companies have new business leaders who have already taken significant actions to cull unprofitable product lines, right-size cost structures and streamline operations. Teva Pharmaceutical is also rolling out new product offerings to the marketplace and Endo Pharmaceutical has a considerable new product opportunity with the potential to deliver incremental sales ahead of expectations over the next couple of years. Both companies have been under pressure, similar to peers, due to a multi-year cyclical downturn for generic pricing and ongoing concerns on future litigation expenses from historical opioid sales and alleged price-fixing. Both Teva and Endo were down significantly during the quarter. Current valuation levels for the companies appear to already be discounting significant future litigation expenses. Also, the history of the industry has shown settlements tend to be manageable for companies and paid out over multi-year time periods. Meanwhile, generic fundamentals appear to be turning around as recent industry pricing has started to stabilize. With the current earnings yields between 30-40%, a lot of fear appears already priced into the securities, making any change in market perceptions on the well-known risks potentially leading to higher market prices as both companies are at deep discounts to their intrinsic value.

Finally, the last remaining recent driver of negative price volatility has been our exposure to and holdings within the Energy sector. As we highlighted in our last quarterly letter, we see a significant disconnect between portions of the Energy sector market prices and current commodity prices. At the current price for oil, a significant portion of our holdings were historically at a much higher valuation. While the market memory of late last year’s commodity price volatility remains top of mind, we see a greater likelihood of stable-to-improving prices. During the quarter we increased our weighting to the Energy sector, and Nabors Industries (NBR), highlighted in our Q4 2018 letter, became one of our top holdings. While it is possible in the near-term that Nabors may experience some volatility in U.S. rigs under contract, we see their operations stabilizing and improving over the next couple of years as they continue to improve their fleet mix to more profitable higher-end rigs and scale up their international and new service operations. Nabors should continue to generate strong free cash flow that should accelerate in 2020 and beyond. Success in continuing to de-lever the balance sheet should accrue significant value to shareholders. We believe the company is currently at more than a 75% discount to their long-term intrinsic value.

Remaining patient and invested through these short-term negative price moves that we saw this quarter creates greater long-term embedded return potential instead of permanent capital loss. Following the valuation spread widening and underperformance during 2014-15, our Deep Value Strategies were up in excess of 40% from their lows. Similarly, we first started the Deep Value Strategy in mid-2000 close to the prior cycle peak of growth versus value and low volatility versus value, generating investment performance well ahead of the market from 2000 to 2006. We believe the Deep Value Strategies today are more attractive than those prior peaks with an even greater embedded future return potential. Collectively our holdings are 40-50% below their 52-week highs and near all-time low valuation levels. We have stayed disciplined to our investment process, using the temporary short-term price moves to add to our high conviction positions. Year-to-date, we’ve added to over 70% of our recent performance detractors, while trimming 70% of the recent positive performance contributors. Our clients have the potential to benefit over the coming years from our portfolio holdings seeing significant margin improvement, accelerating earnings and free cash flow power and hopefully some valuation expansion along the way. Sounds a lot like what the overall market has experienced from 2008/09 to today!

It’s a privilege to manage money for our clients and we welcome the opportunity to educate prospective clients on our Deep Value Strategies.

Daniel Lysik, CFA

| Valuation Characteristics | Deep Value | Concentrated Deep Value | S&P 500 |

| # Holdings | 46 | 22 | 500 |

| % Below 52-Week High | -44.2% | -51.4% | -9.4% |

| Return to 52-Week High | +79.3% | +105.8% | +10.4% |

| Current Price-to-Book (P/B) | .47x | .41x | 3.13x |

| 15-Year P/B Average | 2.05x | 2.60x | 2.75x |

| Return to 15-Year Average | +336% | +534% | -12% |

| Current Price-to-Cash Flows (P/CF) | 2.24x | 1.81x | 12.74x |

| 15-Year P/CF Average | 7.79x | 9.44x | 10.40x |

| Return to 15-Year Average | +248% | +422% | -18% |

| Current Price-to-Sales (P/S) | .22x | .17x | 2.19x |

| 15-Year P/S Average | 1.30x | 1.26x | 1.60x |

| Return to 15-Year Average | +490% | +641% | -27% |

Data shown for representative accounts and is as of 6/30/19. Source: Thomson Reuters.

Daniel Lysik, CFA manages two strategies: Deep Value Strategy focuses on out of favor securities at very low valuation levels and deep discounts to their intrinsic value, whose current market price does not reflect the companies normalized earnings for free cash flow power, and Concentrated Deep Value Strategy, which is the most deeply mispriced subset of the Deep Value Strategy and typically provides greater exposure to lower market capitalization holdings. Email us for more information and how to invest.