Deep Value Strategy 4Q 2018 Letter

The year began with the strongest January market returns in over 20 years only to end the year with one of the weakest quarters since the Great Recession and the worse December since the 1930s! The concerns that weighed on the marketplace in the fourth quarter seemed to grow as the quarter progressed, starting with fears of excessive future rate increases by the Federal Reserve, growing trade issues between U.S. and China, slowing global economic conditions, and finally government and political uncertainty. The market correction was swift and driven by a significant valuation contraction, a 20%+ reduction in the market’s price-to-earnings multiple, the third largest decline in over 40 years (only 2000 and 2002 saw worse).

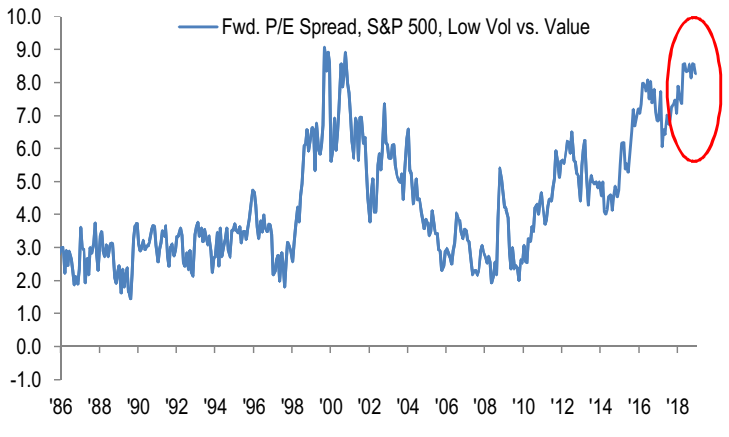

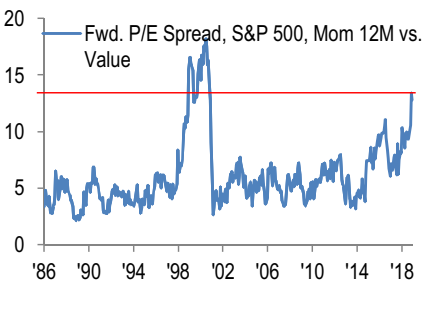

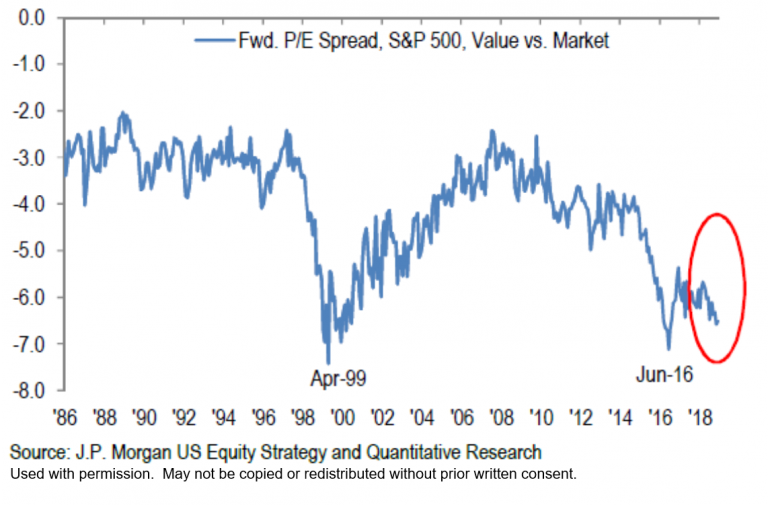

The equity market saw record outflows as recession fears rose and the investors herded to perceived “safe havens”. Market participants’ growing demand for government bonds drove yields lower causing bond multiples to increase to nearly 3x the market earnings multiple! As volatility increased, equity market participants turned to bond proxies, i.e., low volatility and momentum securities, further widening the valuation bifurcation within the equity marketplace. The price-to-earnings difference between low volatility/momentum and value securities closed the year near 30+ year extremes, approaching the historical peaks of the late 1990s! The perceived “safe havens” had once again become “risk havens” – crowded positions which will likely lead to future lower returns.

Used with permission. May not be reproduced without prior written consent.

As we discussed in Hidden Value Opportunities, defensive and growth equities are approaching historically high levels within Index funds. These subsets have been beneficiaries of lower interest rates, a slow economic recovery and momentum driven capital flows from quantitative funds.

Having started a Value Strategy back in June 2000, I remember how out of favor and attractive Value securities were back then and see some similarities to today. I also remember the significant positive Value outperformance cycle which began soon thereafter, from 2000 through 2006, as Value equities outperformed Growth equities by more than 100% and significantly outperformed the overall equity market.

Used with permission. May not be reproduced without prior written consent.

If history is any guide, the greater the valuation divergence between Value and the overall market, the greater the likelihood of future outperformance. Given the 30-year extreme valuation spreads that have developed in the market versus Value securities, we would not be surprised if we are entering a time period of more favorable returns. While the market is paying up for perceived safe havens, it looks timely to be greedy and purchase the Value securities that are on sale!

Our Deep Value Strategies were not spared in Q4, and experienced a pull-back last year of similar magnitude to 2012 and 2015-early 2016 time periods. The Deep Value Strategy finished the year down 13.1% (net of fees)1, nearly 4% behind the S&P 1500 Value Index and 8.7% behind the overall market. Our Concentrated Strategy finished the year down 7.6% (net of fees)1, almost 2% ahead of the S&P 1500 Value index and 3% behind the S&P 500 Index. Both portfolios experienced significant multiple compression, nearly 25% on various valuation measures. The magnitude of the pullback is very similar to what we have seen in historical trough time periods. When our Deep Value Strategies underperform due to significant multiple contraction, they tend to recover in the not too distant future as market prices begin to narrow the greater price gap to their fundamental value.

With the market down double-digit percentages and our Strategies lagging, there weren’t a lot of holdings that had positive returns. Genworth (GNW) one of our largest holdings in both strategies, was the top contributor in the quarter. Genworth is in the process of being acquired by China Oceanwide for $5.43/share. The closing of the transaction has taken longer than originally expected due to a modification of the original deal structure to satisfy U.S. regulators and a lengthy regulatory approval process. As there’s progress in the regulatory process, we expect the deal to successfully close in the early part of 2019.

The recent market environment reminds us of early 2016 when global economic fears rose, recession fears increased and cyclical sectors underperformed the most. During the 4th quarter, our Consumer Discretionary, Energy and Financial sector holdings saw significant price weakness. These sectors generated more than half of the drawdown. Staying true to our investment process, we took advantage of the weakness and increased position sizes in our holdings that possessed the greatest reward/risk opportunity. Bed Bath and Beyond (BBBY), Avon Products (AVP) and Nabors Industries (NBR) are a few of the positions we added to during the market weakness and are in our top holdings in both Strategies.

As we mentioned last quarter, Bed Bath and Beyond and Avon Products are very compelling turnaround stories as both management teams are transforming the business by streamlining operations, rolling out new technology systems, enhancing new product innovation and re-engaging with their target consumer. While the marketplace is currently unconvinced on a successful turnaround, we see early signs suggesting that normalized earnings and cash flow over the coming years will likely be significantly higher than current levels. In addition, both companies have an extensive asset base that is not reflected in the current share price, providing an investor with an additional margin of safety.

Growing recession fears have also weighed on commodity prices during the quarter as the price of oil fell by more than 30%. Energy company share prices in some instances fell even more than the commodity to valuation levels that were below when the price of oil bottomed in the low $30s late in 2015. In our opinion, the price weakness appears way overdone as we selectively increased some of our energy holdings during the quarter. One such holding, Nabors Industries (NBR), a leading global land driller, remains in our top holdings list. Nabors was under considerable pressure during the quarter, as the market assumed the lower oil prices will eventually lead to significant rig cancellations and weigh on Nabors’ future operations. Over the past couple of years, Nabors has been upgrading their fleet, treating the rig as a technology-enabled platform. Their SMARTRigs, whose design and proprietary software carry over 450 patents, have been in strong demand. Nabors has long-term contracts to bring nearly 20 higher-end rigs to the market over the coming year, which should enhance revenues and margins and help offset unexpected weakness in their remaining operations. The company has also recently announced incremental cost-saving initiatives and is scaling back discretionary capex to further enhance free cash flow generation and debt reduction. The company also has a new JV arrangement with Saudi Aramco that will have significant assets that we believe are also being overlooked in the marketplace. With the stock price near $2/share, Nabor’s current market price is at a 70% discount to book value. Looking out over the next 3 to 5 years, Nabors appears very attractive at a low single-digit normalized p/e multiple and a 40%+ normalized free cash flow yield.

In the market pullback in 2015 through early 2016, the housing sector came under considerable pressure as most homebuilders were making new 52-week lows, as their market prices approached and in some cases went below their book values. Investments in the housing sector, particularly in companies with market prices at significant discounts to book value, proved to be very successful. During 2018, homebuilders again went out of favor as rising raw material prices began to pressure margins and higher mortgage rates lead to lower consumer demand threatening future revenue and earnings. Similar to 2015-16, market prices for the whole industry pulled back sharply reflecting the near-term market concerns. We saw the significant dislocation and lack of consensus interest as a great contrarian opportunity that could again lead to an attractive long-term value investment opportunity. During the fourth quarter, we initiated a position in William Lyon Homes (WLH) for both our Deep Value Strategies. William Lyon’s share price is off more than 60% from its highs, due to market concerns on the potential impact of a weakening California housing market, one of William Lyon’s largest and most profitable markets. However, through our analysis we found the company to have a strong asset base (land portfolio), that would provide a margin of safety if industry conditions worsened. In addition, William Lyon’s CEO has enhanced the company’s positioning, focusing on first-time homebuyers and baby boomers. He has also focused on bringing a new lower square footage design to Northern California/Seattle which should be well received in the marketplace over the coming year. We believe the company is well positioned to generate strong free cash flow over the next couple of years, which will be used to further de-lever the balance sheet, creating incremental equity value for shareholders. While market expectations remain low, William Lyon Homes has the potential to be a rewarding investment.

The dislocations that we saw at the end of the year have resulted in significant short-term volatility. We have remained disciplined in our investment approach and have been actively taking advantage of the market fears to benefit our clients over the long-term. The valuation levels of the Deep Value Strategies have always been the best indicator of future return potential. As the chart highlights below, the Strategies absolute valuation measures ended 2018 near all-time lows. Following the underperformance from 2015 to early 2016, our Deep Value Strategies returned >40% over the following year. We are as confident as we have been at any time in the past that our clients are well positioned to generate returns in excess of the overall market over the coming years.

Daniel Lysik, CFA

| Valuation Characteristics | Deep Value | Concentrated Deep Value | S&P 500 |

| # Holdings | 47 | 20 | 500 |

| % Below 52-Week High | -45.9% | -48.1% | -20.7% |

| Return to 52-Week High | +84.8% | +92.7% | +26.1% |

| Current Price-to-Book (P/B) | .4x | .3x | 2.8x |

| 15-Year P/B Average | 1.9x | 2.4x | 2.8x |

| Return to 15-Year Average | 390% | 693% | -1% |

| Current Price-to-Cash Flows (P/CF) | 1.4x | 1.1x | 11.0x |

| 15-Year P/CF Average | 7.0x | 7.7x | 10.4x |

| Return to 15-Year Average | 392% | 617% | -5% |

| Current Price-to-Sales (P/S) | .2x | .1x | 2.0x |

| 15-Year P/S Average | 1.3x | 1.3x | 1.6x |

| Return to 15-Year Average | 526% | 885% | -18% |

Daniel Lysik, CFA manages two strategies: Deep Value Strategy focuses on out of favor securities at very low valuation levels and deep discounts to their intrinsic value, whose current market price does not reflect the companies normalized earnings for free cash flow power, and Concentrated Deep Value Strategy, which is the most deeply mispriced subset of the Deep Value Strategy and typically provides greater exposure to lower market capitalization holdings. Email us for more information and how to invest.