Deep Value Strategy 2Q 2018 Letter

During the past quarter, our Deep Value and Concentrated Deep Value strategies significantly outperformed the S&P 500 by 15% and 25% (net of fees)1. As we indicated in our last quarterly letter, it’s been our experience that when the strategies lag the overall market and approach historically low valuation levels, it has led to attractive future investment returns. At the end of Q1, numerous valuation characteristics were below early 2009, mid 2012 and late 2015 (all prior troughs).

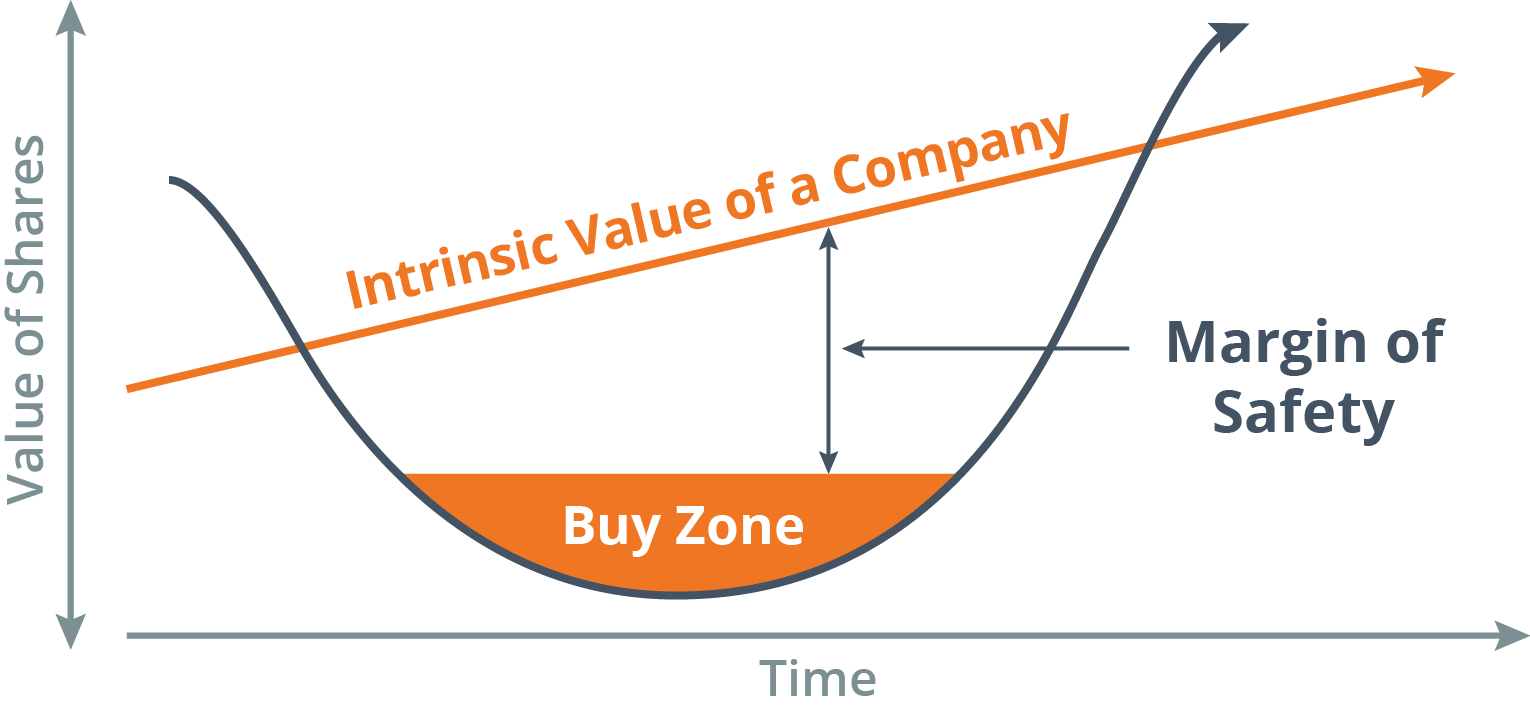

Benjamin Graham highlighted on numerous occasions the importance of patience for value investors. “The disciplined, rational investor neither follows popular choice nor plays market swings; rather he searches for stocks selling at a price below their intrinsic value and waits for the market to recognize and correct its errors. It invariably does and share prices climb. When the price has risen to the actual value of the company, it is time to take profits, which then are reinvested in a new undervalued security.” We couldn’t agree more. Below is a chart that we have shared with clients in the past to further highlight our investment approach.

As the market price for an investment falls further below its intrinsic value, the long-term investment return opportunity and the margin of safety increases. Holdings that weigh on near-term performance have the potential to recover in price and lead to attractive long-term returns for our clients. In our experience, following this framework has allowed us to remove emotion from the investment process and take advantage of short term dislocations. A repeatable process that provides confidence to go against the crowd.

During the second quarter, both strategies had a significant number of holdings up in excess of 20%, a level not seen since 2013. The top contributors to the strategies significantly outperformed the detractors by a margin of 3 and 4 to 1.

| % of Holdings >20% in Q2 | Top Contributors

Avg. Weight / Contribution |

Top Detractors

Avg. Weight / Contribution |

Top Contributors to Top Detractors | |

| Deep Value | 38% | 19.9% / 11.2% | 11.3% / -3.7% | 3.2 |

| Concentrated Deep Value | 57% | 35.0% / 20.1% | 26.1% / -4.8% | 4.2 |

A significant portion of positive investment performance during the quarter was generated by the consumer discretionary, energy and healthcare sectors. The first two sectors also lead the overall market increasing by 8% and 13%, respectively. Last year, we discussed the dislocation that was happening in the generic/specialty pharma and retail sectors. In some instances, security market prices fell to levels that were below book value, free cash flow yields rose to levels in excess of 30% and earnings yields to greater than 20%. Rent-A-Center (RCII), Supervalu (SVU), Endo Pharmaceuticals (ENDP) and Teva Pharmaceuticals (TEVA) were some of our largest detractors. We added to all of these holdings as they approached their 52-week low maintaining them within the top holdings of each strategy. During the second quarter, these holdings reversed course and were up 35-70%. Rent-A-Center lead the group, being acquired by buyout firm Vintage Capital. We continue to like the prospects for Endo Pharmaceutical and Teva Pharmaceutical as they are making significant enhancements to their infrastructure, reducing redundant manufacturing facilities, discontinuing unprofitable products, right sizing cost structures and preparing to launch new products. Both companies maintain attractive double-digit earnings and free cash flow yields, providing the potential for considerable upside over the next couple of years.

As some holdings begin to recover towards their intrinsic value, we remain excited about attractive value opportunities that still exist in the market today. Frontier Communications (FTR), GNC Holdings (GNC), Deutsche Bank (DB), Brighthouse Financial (BHF) and Avon Products (AVP) were some of our biggest detractors. Similar to the past, we added to their positions during the quarter. Some of these companies have seen considerable pressure over the past year as their current equity prices are at multi-year lows and a significant discount to their fundamental values. However, when you look at their balance sheets and public debt we see limited near-term liquidity risk. The companies generate significant free cash flow, have extensive asset bases and have equity free cash flow yields well in excess of 30%. With free cash flow being used to reduce debt, there are significant long-term benefits to shareholders. Levered free cash flow should begin to move towards unlevered free cash flow as interest expense is reduced, further unlocking more free cash flow to be used for the benefit of all stakeholders. We think there is significant appreciation potential in the equity market price of each of these companies as the equity value has the potential to be unlocked from an improving capital structure.

The energy service sector has seen significant overhang over the past couple of years from excess of supply added near the peak in oil prices. As industry day rates have fallen to near cash cost levels we have seen an accelerating pace of excess supply leaving the marketplace, not too dissimilar to other cyclical industries that have gone through a long protracted downturn. In our opinion, this sets the stage for a significant opportunity for market leaders to benefit over the coming years from a recovery in pricing and higher fleet utilization. Current market prices of Nabors Industries (NBR) and Noble Corp (NE) are below tangible book value and provide significant appreciation potential over the next couple of years as their earnings and free cash flow improve to normalized levels.

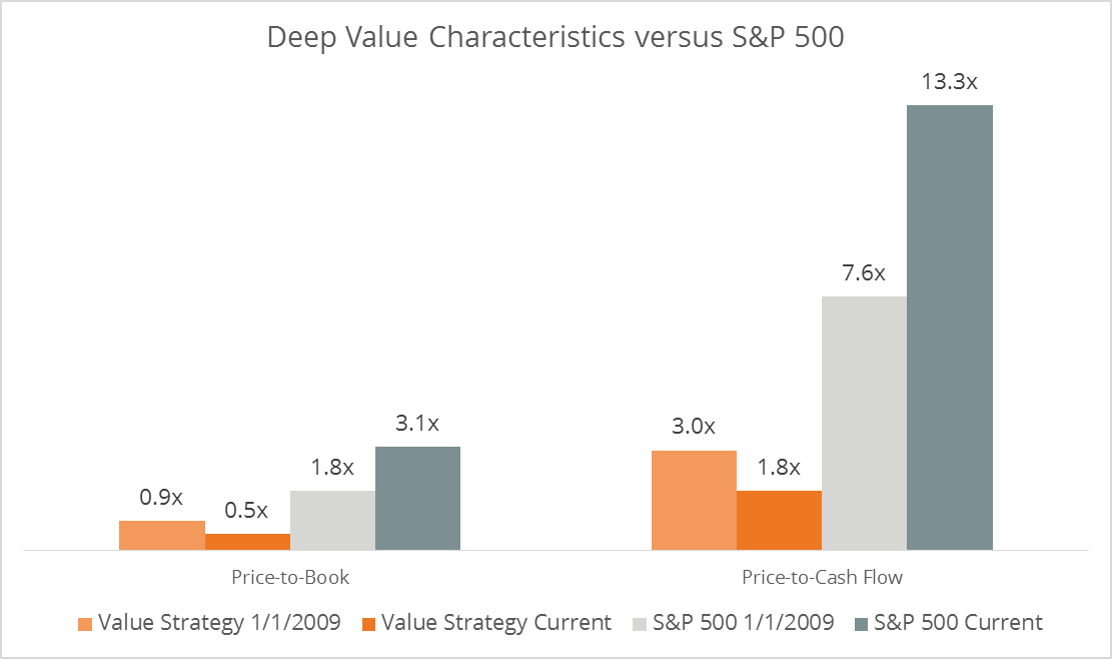

We continue to believe that the strong economic environment should lead to an improving earnings profile for sectors which make up a significant portion of the Value indices. The low valuation, out-of-favor subset of the market is as attractive as it has been over the past 20 years. As the chart below highlights, our Deep Value Strategy’s current price to book and price to cash flow are significantly lower than 2009 levels.

However, the overall market has seen significant valuation expansion from the lows in early 2009, a near doubling of these valuation characteristics which have been a significant contributor to overall market investment returns. The growth portion of the marketplace has been an even greater beneficiary, as their current price to book approaches 5.5x and a cash flow multiple 17x, expectations remain high! While our Deep Value strategies have low expectations, with current holdings at low single-digit cash flow multiples, 50 to 60% discount to book value, forward earnings yield of 14-17% and free cash flow yields in excess of 20%. However, we are VERY excited about future prospects. Our Deep Value strategies resemble the overall marketplace in early 2009, with significant valuation expansion potential to benefit future performance returns. While difficult to know how the strategies will perform over the short-term, we believe our clients will be significantly rewarded over the coming years!

Daniel Lysik, CFA

Daniel Lysik, CFA manages two strategies: Deep Value Strategy focuses on out of favor securities at very low valuation levels and deep discounts to their intrinsic value, whose current market price does not reflect the companies normalized earnings for free cash flow power, and Concentrated Deep Value Strategy, which is the most deeply mispriced subset of the Deep Value Strategy and typically provides greater exposure to lower market capitalization holdings. Email us for more information and how to invest.