Every quarter, we hold a call with clients to discuss our outlook for the market and review our strategy positioning. Below is an edited version of Bill Miller’s comments on the market.

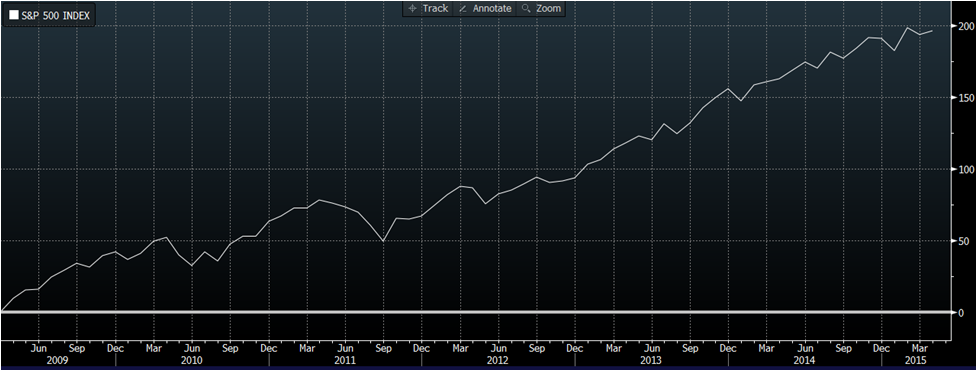

I’ve said the same thing now quarter after quarter after quarter on the economy and on the market, which is that we are in a bull market. The bull market began in March of 2009, and continues today. Looking at a simple chart of the stock market’s performance, you can see it goes from lower left to upper right.

It doesn’t do it linearly, but the bull market has been remarkably steady and it’s been driven by an improving economy, solid liquidity, good earnings growth, great free cash flow, and no real competition from interest rates which remain just above all-time lows.

I don’t see anything in the current environment, certainly endogenously, with respect to the overall market that would change that. The economic numbers, generally speaking, have been constructive but not overwhelming.

When you look at the foundations of a bull market, which are liquidity, growth, and valuation, what we see is that all of those drivers are intact. But, they are not as attractive as they were a year ago. A year ago, the Fed was actually adding liquidity. Now the Fed is not doing that, but they’re not reducing liquidity. That process will begin with the first rate hike.

June is probably unlikely given that we’re already getting into May, and the numbers have to be powerful to have a June lift off. But September to December, barring some accident, probably makes sense, although the Fed has said they will be data-driven.

Overall, liquidity is fine, growth remains solid, and valuations, while not as attractive as a year ago on an absolute basis, are still very attractive compared to the level of interest rates. The great bull market of the 1990’s, which pushed valuations to levels much higher than today, occurred when the average level of rates on the 10 year bond was 6%, almost triple the current level.

To address the second pillar – growth. The S&P this quarter is not going to have probably any earnings growth, but that’s due virtually entirely to the energy sector. We’re still working through the impact of the cut in oil prices that have fallen in half. So, the decline in expected earnings for the S&P this year is due solely to declines in the energy sector. By and large, the other sectors are pretty much what people had expected.

So, I think it’s a little bit misleading when people say that earnings are not going to grow this year. For most companies, they’re going to grow. For the energy sector, they’re not going to grow. But energy is energy – and energy prices may or may not be at a bottom, but that’s underpinned, I think, a decent market. The decline in energy prices since last summer is not good for the energy sector, but it is a clear positive for consumers, who make up 70% of GDP, and for the economy as a whole.

And lastly, valuation. Again, valuation is not as attractive as it was a year ago, but that’s primarily because of two things: last year the market was up more than earnings were up, and this year earnings on the energy side have come down. So valuation on the overall market at 17 or 18 times is much closer to what we would consider where values and interest rates would normalize, but interest rates haven’t normalized. And again, that one-point rise in the multiple is the drop in energy earnings. And so, if we believe the forward curve, then over the next couple of years, energy prices will rise moderately and earnings on that side of the market will be fine.

Overall I think the path of least resistance for the market remains higher. The U.S. market has been outperformed by other markets around the world, and that’s not a big surprise. Some markets that have done super well, like Russia, are only doing well because they were also horrible last year, but other markets that are doing well, such as Continental Europe, are doing well because of the massive more or less open-ended Q.E. that’s going on over there and that’s boosting liquidity and boosting growth prospects.

So, I think that the global outlook correctly is solid, and the U.S. outlook is good, but we’re not going to see, in my opinion, the kinds of very significant gains we’ve seen in many years since 2009, but still gains could be quite satisfactory. I think the equity risk premium over bonds is still pushing towards the high end of the range and we will see the real return of equities in the five percent to six percent range, so call it, adding inflation, seven percent to eight percent overall, which is pretty good in this kind of environment.