Deep Value Strategy 3Q 2017 Letter

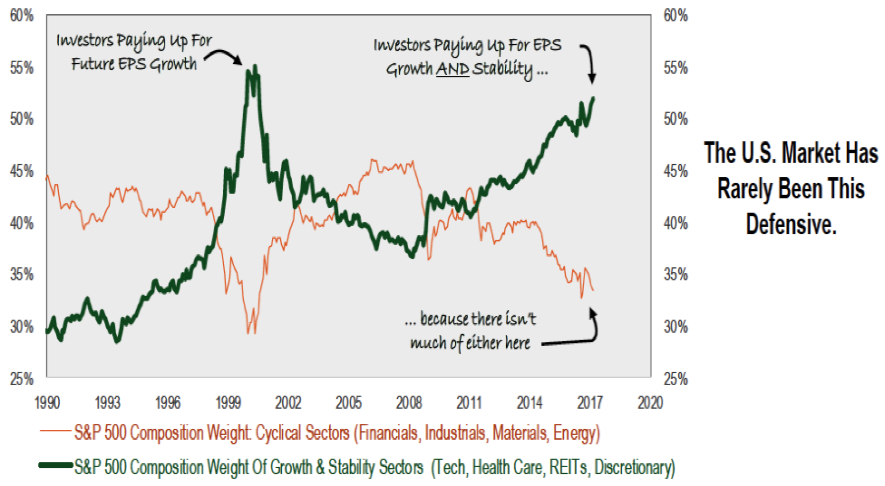

Over the past couple of years, the constant drumbeat is: we are “late” cycle and on the verge of the next recession/market correction; interest rates and inflation will remain low for the foreseeable future; volatility equals risk. These misperceptions have led to record capital flows into low volatility, defensive, growth-oriented, and stability investments. The dispersions being created in the marketplace are approaching significant historical levels. As an example, the chart below shows that the S&P 500 sector weightings based on Growth & Stability is approaching levels last seen in the late 1990’s/early 2000 time period. “Growth and Stability” are becoming very crowded!

We have also witnessed a growing appeal for low volatility investment strategies. In the wake of the 2008-09 recession, the relationship between price and underlying value has been lost as market participants now associate lower volatility with lower risk and have redefined what they believe to be better investment returns. To a value investor, a security’s attractiveness is NOT derived by the observation of the historical movements in its market price. A stock is ownership in an actual business, and it’s that company’s underlying intrinsic value in relation to the market price that determines its attractiveness as an investment and its future return prospects. Recently the marketplace has been increasingly shying away from companies with a falling stock price and rising volatility, regardless of whether there is intrinsic value in the company and a growing margin of safety.

Since early 2009, the S&P 500 has appreciated in excess of 200%, as returns have been fueled by an ongoing profit recovery cycle. Also significantly contributing to those returns has been a meaningful expansion of valuation multiples. In the chart below, we look at four of these valuation metrics and how they have changed, increasing by 50 to 100%+:

| Current | March 2009 | Change | 20-Year Average | Current vs. 20-Year Average | |

| Forward Price to Earnings | 17.7x | 10.1x | 75% | 16.4x | 8% |

| Price to Operating Cash Flow | 13.6x | 6.6x | 106% | 13.5x | 1% |

| Enterprise Value to Sales | 2.4x | 1.4x | 71% | 2.1x | 14% |

| Price to Book | 3.0x% | 2.0x | 50% | 2.9x | 3% |

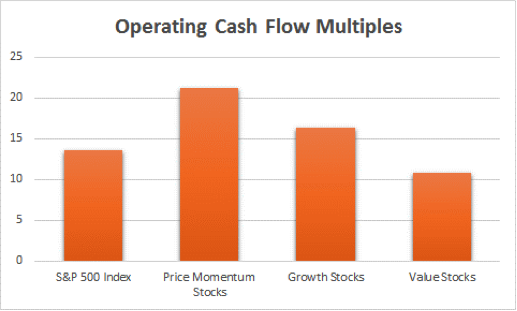

One may look at today’s market valuation multiples, now slightly higher than the long-term normal, and conclude investment opportunities are limited. We would disagree! Hidden are attractively priced securities – those with market prices far below their underlying fundamental value and that have the potential to be long-term investment opportunities. While it’s not easily seen, the recent valuation expansions have not been equal across all market participants. As a result of crowded investment themes, we have seen a widening of valuation between subsets of the market. Looking at operating cash flow multiples as an example, the Value universe is below the overall market, 40% lower than the Growth Universe and half that of Price Momentum stocks.

Looking at other valuation measures leads to similar findings, but in some cases (e.g. price-to-book) one will find significantly wider dispersions. While “Stability” categories are at the higher end of their valuation ranges, some cyclical companies continue to fall to new lows.

As we have seen during previous time periods, crowded investments tend to create significant divergences and the potential for attractive investment opportunities. As Ben Graham highlighted on numerous occasions “The marketplace is a pendulum that forever swings between unsustainable optimism (stocks become less attractive), and unjustified pessimism (which makes them too cheap)”. Superior long-term returns are created by identifying and taking advantage of these dislocations, “selling to optimists and buying from the pessimists” (again, Ben Graham). With deregulation taking place and the possibility for meaningful tax reform, one can see the potential for an improving economic environment over the coming year, which should lead to rising inflation and a pathway to higher interest rates. Historically that has been a very positive backdrop for Value stock returns. We suspect we will find that to be the case again.

Daniel Lysik, CFA manages two strategies: Deep Value Strategy focuses on out of favor securities at very low valuation levels and deep discounts to their intrinsic value, whose current market price does not reflect the companies normalized earnings for free cash flow power, and Concentrated Deep Value Strategy, which is the most deeply mispriced subset of the Deep Value Strategy and typically provides greater exposure to lower market capitalization holdings. Email us for more information and how to invest.