Deep Value Strategy 1Q 2021 Letter

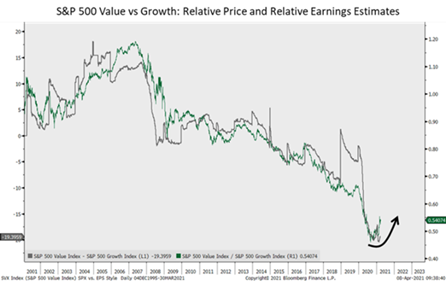

We recently passed the one-year anniversary of the Covid-19 pandemic outbreak. Wow, what a year! As we reflect back on last spring, it is hard to forget the significant market fear and 30% correction in the stock market. During Q1 2020, low valuation securities (cyclical and smaller companies) significantly underperformed as valuation spreads widened to levels last seen in the 1973-74 and 1999-2000 time period. The two historical time-periods are significant as they both mark the beginning of multi-year upswings for value stocks.

In our Q1 2020 quarterly letter, we highlighted the significant potential opportunity: “The most attractive valuation securities have outperformed the overall market over long time periods. However, we have seen significant short-term periods of underperformance, as the price-to-value gap widens. These time-periods have been followed by significant appreciation and relative outperformance. Price discovery has historically been faster than expected during recovery time-periods. While market participants continue to overweight crowded low volatility and long-duration equities, an investor appears much better served taking a longer time horizon by focusing on companies with significant price dislocation that have normalized earnings and free cash flow yields that are significantly higher than the overall market.”

Low valuation securities performance significantly improved in the second half of 2020, leading the overall market in the fourth quarter and again in the first quarter of 2021. This is the first time Value has lead Growth for two consecutive quarters going back four years! It is a welcome change. However, with Value lagging over the past 10 years the marketplace questions sustainability. We see an environment continuing to be supportive for long-term improvement in low valuation securities. During 2020, we highlighted wide valuation spreads within the equity market, accelerating relative earnings

performance by parts of the market that have greater representation in Value indices, rising interest rates and inflation expectations. History has shown when these drivers are in place, more often than not they have tended to coincide with strong investment performance for Value stocks.

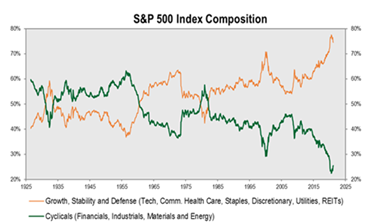

Even with cyclical stocks performing better in Q4 2020 and Q1 2021, as the chart below highlights, their representation in the overall market still remains near all-time lows.

Similar to the past, we see the likelihood of cyclical sector representation increasing as earnings recover and likely exceed the overall marketplace. As the chart below highlights, the Growth universe has had strong earnings growth for most time-periods since The Great Recession, which has coincided with

a low GDP growth (demand) environment.

The Covid-19 induced lockdowns had an adverse impact on many cyclical companies over the past year providing the potential for significant operating leverage as these companies return to growth. We believe better management teams have also worked hard during the recent downturn to enhance their business model, positioning their company to have greater earnings and free cash flow power potential during the upcoming recovery. With the significant Covid-Era Fiscal stimulus (>$5 Trillion), we would not be surprised to see the economic recovery much stronger than current market expectations which would have a very favorable impact on Value universe’s relative earnings growth. A return to normalcy should continue to support low valuation securities.

Where could we be wrong in our view? Covid-19 vaccinations not reaching levels that create herd immunity in a timely manner, delaying States fully reopening and pushing out the recovery. As we have seen early in the second quarter, the market can become very concerned if there are any delays in vaccinations. As we have highlighted in the past an accommodative Federal Reserve and sizable Fiscal stimulus are a natural offset to near-term risks and should allow the economic recovery to persist not only throughout 2021, but well into 2022 and potentially beyond. It is also worth mentioning that the steepness of the yield curve and signs of improving inflation are now present which are also favorable to significant portion of the Value universe.

With valuation spreads between the least (Value) and most expensive stocks (momentum/long-duration equities) remaining wide and the market potentially underestimating earnings and free cash flow power for portions of the marketplace, we continue to see a favorable set-up for Value stocks over the coming year.

Strategy Highlights

The Deep Value strategy is off to a strong start to the year, building upon the positive inflection in investment performance seen in the second half of 2020. For the first quarter, the Deep Value strategy was up more than 60%, significantly ahead of the overall market and the S&P 1500 Value Index.

During the quarter, our holdings saw significant price appreciation with nearly half of our holdings up in excess of 60% and nearly one third of the portfolio up in excess of 80%. Nabors Industries (NBR), Chicos (CHS), and Gannett (GCI) were significant positive contributors to performance during the quarter. Even with the recent strength, these three holdings’ share prices remain BELOW pre-Covid-19 price levels and we believe their intrinsic value is still multiples of the current share price. Nabors has benefitted from stronger crude oil and natural gas prices and a recent pick-up in drilling activity. However, the company remains attractive as their normalized free cash flow yield is greater than 50% and remains a steep 70%+ valuation discount to its peers. Chicos’ share price has also started to recover as their stores begin to reopen from the pandemic closures, but still reflect limited value for normalized earnings and free cash flow for their significantly growing Soma brand.

We would also like to highlight the recent acquisition offers for Tribune Publishing (TPCO), confirming the private market value for Gannett’s extensive asset base is likely meaningfully higher than $10/share. In addition, The New York Times (NYT) provides a potential roadmap for Gannett shareholders on the equity value to unlock potential from their current transformation program. One of Gannett’s main growth initiatives is to generate 10M digital subscribers over the next couple of years. The New York Times was highly successful in rolling out a similar digital subscription focus that led to an inflection in growth and given the attractive market valuation of digital subscriber businesses created significant valuation expansion for overall enterprise. We believe success on Gannett’s transformation program and debt elimination goal over the next couple of years should unlock equity value and potentially lead to a share price increase of more than five times current market price levels.

Late last year we initiated a position in Unum Insurance (UNM). The company looks like an interesting recovery investment from the Covid-19 induced downturn. As an employee benefit leader, Unum has a disciplined risk managed approach to pricing and claims, strong distribution channels, and sizeable market share. Management has historically generated strong margins and a double-digit Return on Equity (ROE) in their core business. Their U.S. operation has recently been investing in new digital offerings and distribution with Large and Mid-size employers, and management is looking to take advantage of the recent market weakness and expand into the smaller employer marketplace. Covid-19 outbreak disrupted some of Unum’s sales channels, weighing on premium growth and creating higher expenses tied to the disability business. These business headwinds should be peaking during the current quarter and lessen as the Covid-19 vaccines become more widespread. We believe operating trends will improve as the year progresses. Unum could also be a significant beneficiary of rising interest rates, which could lessen future capital contribution to their long-term care closed book. The company maintains a strong balance sheet, holding company cash/liquidity of $1.5B and no debt maturities before 2024. Unum’s stock price remains attractive at what we believe is a 50% discount to tangible book value and a greater than 4% dividend yield, with a low 25% payout ratio. We believe the company has the potential to generate $20-22/share in earnings over the next couple of years leading to significant book value growth (potential to exceed $70/share by 2023) and ROE has the potential to return to greater 10% level. We see the potential for the stock price to more than double over the next couple of years.

Conduent (CNDT) is a new holding this quarter and looks like an interesting turnaround opportunity. We believe success on the company’s transformation program has the potential to unlock significant equity value over the next couple of years. The company delivers mission-critical services and solutions by creating digital platforms to help manage millions of transactions for most Fortune 100 companies and 500 governing entities globally. Conduent’s Board recently appointed Cliff Skelton as CEO. Mr. Skelton has impressive transformation and IT experience having previously been President and Chief Information Officer of Fiserv (FISV). Conduent has historically lacked an organized global selling effort, and management needed to repair some of their key client relationships. The CEO has brought in some new senior management that have previously worked with him to help in the turnaround effort. While the company’s top-line was adversely impact by Covid-19, new sales initiatives and better service levels are starting to show promise as the pipeline is up significantly over the past couple of quarters. Over the coming 12 to 18 months, we believe the company could see revenue growth trends stabilize and return to growth. The CEO is also making system investments and looking for additional efficiencies from a greater shared service effort. As these initiatives take hold, we believe Conduent has the potential to see nice margin improvement and narrow the significant gap with industry peers. Similar to our investments in DXC Technology (DXC) and Unisys (UIS), Conduent’s valuation is at a significant discount to its peers. The current share price is 70% below its $23 price high in 2018, creating an attractive market capitalization of only $1.4B for a company with $4B+ in revenue. We see a significant upside potential with a successful transformation. Over the next three to five years, we believe Conduent revenues have the potential to approach $5B and achieve 13% margins. A little more than half peer valuation levels would support a share price >3x current price levels.

Late in the quarter, we started a position in Tenneco (TEN), also an interesting turnaround opportunity. In 2018, Tenneco doubled its size acquiring Federal Mogul, adding more than 25 aftermarket brands and OE powertrain business. The company is one of the world’s leading designers, manufacturers, and marketers of automotive products for original equipment (OE) and aftermarket customers. Tenneco has an extensive asset base and global footprint, >$12B in revenue, >200 manufacturing plants and >30 distribution facilities. Management has a renewed focus on business line optimization, driving margin expansion and cash flow generation. As excess cash aids in debt reduction, significant de-levering has the potential to unlock significant equity value overtime. During the Covid-19 downturn, management launched new programs focused on permanently reducing structural costs ($265M), expanding margins and enhancing cash generation by lowering the capital intensity of the business. Tenneco has the potential to see strong top-line recovery and nice margin expansion. Success on the new cost and growth initiatives could lead to normalized revenue greater than $15B and earnings per share above $4/share. Market expectations are for profits to remain at lower levels and less debt reduction over the next couple of years, providing a nice potential variant. As for risks, we believe the company’s exposure to the internal combustion engine at 40% of revenue is manageable and we anticipate that to become less overtime. The company’s current valuation, less than two times cash flow and less than three times earnings appears to be overly discounting the market’s concerns. Tenneco’s market cap is only $850M, as the company’s share price is 80% below its highs in 2017. With industry peers at higher valuation multiples, Tenneco management success on growing revenue and Earnings Before Income, Taxes, Depreciation and Amortization (EBITDA) during the ongoing auto market recovery and further de-levering the balance sheet through free cash generation and non-core asset sales would support a stock price multiples of current levels.

Finally, we would like to highlight Teva Pharmaceutical (TEVA) and Endo Pharmaceutical (ENDP), which have recently lagged other holdings in the portfolio with ongoing market concerns regarding a successful opioid settlement. Covid-19 outbreak has also affected the court system, causing numerous trial date delays. We would expect the court system to return to normal and trials to resume over the coming months and eventually lead to final settlement. While we appreciate the market’s concern regarding a large liability, history has shown that these settlements end up being at levels significantly lower than market fears. We have taken a longer view and recently increased our position sizes. We believe Endo’s management is transforming the company and see their branded/sterile injectable portfolio driving future revenue growth and margin expansion over the next couple of years. The company’s upcoming launch of Qwo, an injectable for cellulite, has the potential to be a significant new product for the company that could further enhance the long-term growth profile. We believe Endo shares remain very attractive currently at a greater than 30% earnings and free cash flow yield. We have also been impressed with Teva CEO‘s success in transforming the company. With an improving Research and Development pipeline, growing new products and continuing stability in the generics marketplace, we believe Teva will return to growth this year. We see significant long-term opportunity for margin expansion as the company continues to rationalize their global manufacturing footprint. With excess cash flow focused on debt reduction, we believe there is significant opportunity for equity value creation over the coming years. Teva’s earnings yield is currently greater than 25%, significantly higher than the overall market.

The Deep Value Strategy has had a very strong start to 2021 and trailing one-year performance is significantly higher than the overall market. While we recognize it will be hard to match our trailing year performance, we remain very excited about the embedded return potential in the Deep Value strategy today. Nearly one third of our recent performance comes from holdings that are no longer in the portfolio. In fact, more than 70% of the strategy’s weighting are in securities that are still below early 2020 price levels (pre-Covid-19) or have a price-to-earnings multiple less than 4 times. Our current holdings are still well below their price highs, unlike the overall market. Currently, the overall portfolio is trading 69% below five-year price highs. The Deep Value strategy still has normalized earnings and free cash flow yield is greater than 25%. Combining current holdings return to normalized earnings and free cash flow levels with below market valuation levels presents a timely opportunity. We believe there is a long-term embedded return potential close to 300%.

We are excited to see an equity market starting to recognize the significant price to value gap in low valuation securities. We believe our Deep Value strategy provides a distinct investment opportunity differentiated from the overall index. The portfolio’s high active share provides the potential to be additive to a client’s overall asset allocation. We thank our clients for their trust and look forward to working hard to generate attractive investment returns over the long term.