Deep Value Strategy 3Q 2018 Letter

Investing in unpopular mispriced securities takes discipline, a systematic process and a whole lot of patience. Given the marketplace’s short-term orientation, there is a strong desire to participate in areas of the market that are performing well and disregard those that are not. These behavioral biases can often lead to opportunistic security mispricings. We focus on analyzing the neglected areas of the marketplace in hopes of finding attractive investments, which we view as those whose market price is at a deep discount to their intrinsic value.

It’s been our experience that significant price weakness leads to greater pressure on a company’s management to undertake shareholder-friendly actions. In the cases where management is slow to react, outside forces may arise to help assist in narrowing the price gap. During the past quarter, our Deep Value Strategies benefitted from one of these such events. One of our largest holdings, Supervalu (SVU) was acquired by United Natural Foods (UNFI), for $32.50/share. The acquisition price was 65%+ higher than SVU’s previous day’s closing price. Supervalu’s valuable real estate holdings and extensive distribution network supported an intrinsic value that was significantly higher than their market price.

Supervalu along with our holdings in Endo International (ENDP) and Unisys (UIS) were significant positive contributors during the quarter pushing the Deep Value strategies ahead of the S&P 500. The take-outs of Supervalu and Rent-A-Center (RCII), two of our largest holdings, and our successful investments in Fossil Group (FOSL), up over 200% in the first half of the year, have been some of significant positive contributors to this year’s overall performance. While these three holdings collectively represented 10% to 20% of the portfolios earlier in the year, they are now less than 1%. Similar to the past, we have redeployed the gains from successful investments into new value opportunities.

During the quarter, Maiden Holdings (MHLD), Bed Bath and Beyond (BBBY), Seaspan Corp (SSW), Teva Pharmaceuticals (TEVA) and Genworth (GNW) were the largest detractors, albeit their overall drag on the performance was less than half of the top five contributors during the quarter. We continue to believe each holding is well below its intrinsic value and have increased the positions sizes of each in both strategies.

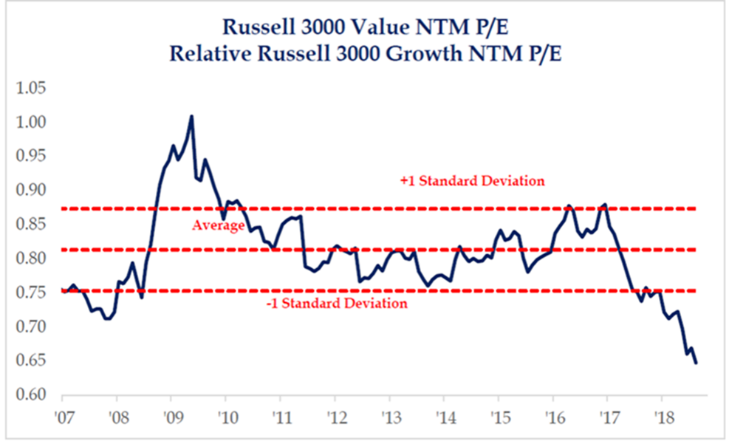

As we have mentioned in previous quarterly letters, investors have become overly concerned at times that the duration of the economic expansion will lead to a significant bifurcation in the marketplace. As you can see from the chart, one-year forward price to earnings multiples of Value versus Growth has fallen to a 35% discount, a 3 standard deviation event!

We find this interesting as average to above average economic growth and increasing interest rates have historically been present during stronger performance periods for Value stocks. Nonetheless, we welcome this valuation divergence as it continues to provide attractive investment opportunities; in the spirit of Benjamin Graham, we see market prices providing a $1 of value for less than $.50. Our Deep Value Strategies remain focused on identifying these favorable reward/risk opportunities whose very low valuation and extensive asset bases provide a high margin of safety. We believe we have recently identified three such opportunities, Avon Products (AVP), Bed Bath & Beyond (BBBY) and Newell Brands (NWL).

We believe Avon is a turnaround opportunity within the Consumer Staples sector. Avon has new leadership – executives who have had significant success at other leading international consumer product companies. CEO Jan Zijderveld, formerly at Unilever, successfully oversaw businesses in 34 countries with sales in excess of $10B. Jan is focused on restoring Avon to its roots as a leading direct selling company. His transformation plan centers on making it easier for Avon’s 6 million sales representatives to be successful, driving faster innovation and utilizing new digital capabilities. Jan is focused on opening up Avon’s extensive international infrastructure enhancing overall profitability and returning the company to attractive top-line growth. Having been at the company for seven months, Jan has already injected new talent in more than half of Avon’s markets, bringing new leadership with local market and turnaround experience. Jamie Wilson, former CFO at SABMiller, has made significant strides over the past 18 months, enhancing Avon’s liquidity and repairing the balance sheet. He is also spearheading the rollout out of new technology systems and realigning Avon’s operating infrastructure, with a focus on reducing costs and enhancing operating efficiency. While Avon’s significant exposure to emerging markets is a near-term concern in the marketplace, we believe Avon’s 90%+ brand awareness in these markets provides very attractive long-term potential. As management continues to make enhancements to the business model, we see opportunities over the next couple of years for operating margins to return to double-digit rates and for the company to generate strong free cash flow. We believe Avon’s current share price carries little value for its extensive asset base and no value for the potential improvement in operations. Insiders appear to have a similar view having recently purchased in excess of $1.5 million in shares. We continue to take a longer-term view versus the marketplace, taking advantage of the recent weakness and making Avon one of our leading holdings within both the Deep Value and Concentrated Deep Value portfolios.

Bed Bath & Beyond is an opportunity that has similarities to investments we have historically made in the retail sector. The company has had a long track record of growth and innovation, generating some of the strongest economic returns in retail. Four years ago, Bed Bath began a significant investment period repositioning for future growth. We’ve seen similar initiatives produce improvements in operations and profitability in other companies. As part of this effort, Bed Bath is making significant investments in new technology systems, enhancing their omnichannel capability, broadening their services and solutions offerings and investing in their infrastructure to not only eliminate costs but enhance capabilities to better serve their customers. By our calculations, the company will be spending in excess of $1B on technology system/infrastructure enhancements. With annual spending levels at nearly 15% of the current equity market capitalization, the market price appears to be providing limited value for any future success from these significant investments. It is worth noting that Bed Bath’s current market price is back to 2000 price levels, yet revenues today are $12B+ versus $2B back then. The company has no liquidity issues, generating $500M in free cash flow over the past year and currently has cash in excess $1B (>$8/share). Bed Bath & Beyond also has an asset-rich balance sheet, with more than $6B in assets (excluding goodwill) versus an enterprise value of only $2.2B! While the marketplace is concerned that the company’s operating margins will continue to contract long after the spending program is complete, we believe the current market price is significantly discounting this risk. In fact, as the investment spending subsides and efficiency initiatives begin to take hold, we see the potential for improvement in operational margins and recovery of earnings off the near-term trough levels. Bed Bath is at all-time low valuation levels, less than 2.5x EV/EBITDA and .2x EV/Revenue – well below private market transactions within the retail sector which provides a patient investor with a margin of safety and potentially a very attractive upside opportunity.

Newell Brands, a 100-year-old consumer company, developed some challenges after undertaking a larger acquisition of Jarden in 2016. As a result of that transaction, the company is in the process of a restructuring program which consists of divesting eight businesses representing 35% of sales. These divestitures should dramatically reduce costs and improve operational efficiency as they consist of more than 50% of company’s SKUs, have lower exposure to a faster-growing E-commerce channel, have 2x greater exposure to commodity prices and represent nearly 70% of the manufacturing footprint. Newell’s remaining core brands will have more than 80% of the business with a #1 market share. They have significant e-commerce penetration to drive future growth and a significantly lower overall supply chain, manufacturing and distribution cost structure. The divestitures upon completion are expected to generate $10B in proceeds, which the company plans to use for debt reduction and share buyback. The valuation potential from this program looks significant as Newell’s total enterprise value is only $16.5B. With asset sales already complete on 25% of the targeted divestitures, the company has $2B+ in cash that is currently being used to reduce debt and start the buyback program. We also like Carl Ichan’s active engagement with the company as a 7% shareholder. New board members have also recently purchased $2M in stock and have strong global consumer backgrounds. Normalized earnings for Newell should be higher than $4/share and achievable over the next two to four years, which would support a stock meaningfully higher than its current market price.

Avon, Bed Bath and Newell are great consumer brand companies that you rarely have an opportunity to purchase at a deep valuation discount to the overall market and their fundamental value. Representation of these holdings in the Strategies today now mirror the combined holdings in Rent-A-Center, Supervalu and Fossil Group earlier this year. We look forward to hopefully being able to share good news at some point in the future regarding these investments.

While market gyrations may continue over the coming year regarding perceptions of the economic cycle, it is our belief that this will favor high active share strategies at a valuation discount to the market. Our Deep Value Strategies, with active share in the high 90s and low single-digit cash flow multiples, 50 to 60% discount to book value, forward earnings yield of 14-17% and free cash flow yields 3x+ the overall market, appear well-positioned for the current environment. While it is difficult to know how the Strategies will perform over the short-term, we believe investing in mispriced securities will reward our clients over the long-term!

Daniel Lysik, CFA

Daniel Lysik, CFA manages two strategies: Deep Value Strategy focuses on out of favor securities at very low valuation levels and deep discounts to their intrinsic value, whose current market price does not reflect the companies normalized earnings for free cash flow power, and Concentrated Deep Value Strategy, which is the most deeply mispriced subset of the Deep Value Strategy and typically provides greater exposure to lower market capitalization holdings. Email us for more information and how to invest.